Travel Insurance for Children: 3 Crucial Benefits

Why Travel Insurance for Children is Essential for Every Family Trip

Travel insurance for children is a simple way to protect your trip and your wallet. It covers costly surprises so you can focus on making memories.

Quick Answer:

- Yes, you can buy travel insurance for children – as a standalone policy or by adding them to a family plan.

- Many insurers offer free coverage for kids under a certain age when traveling with insured adults.

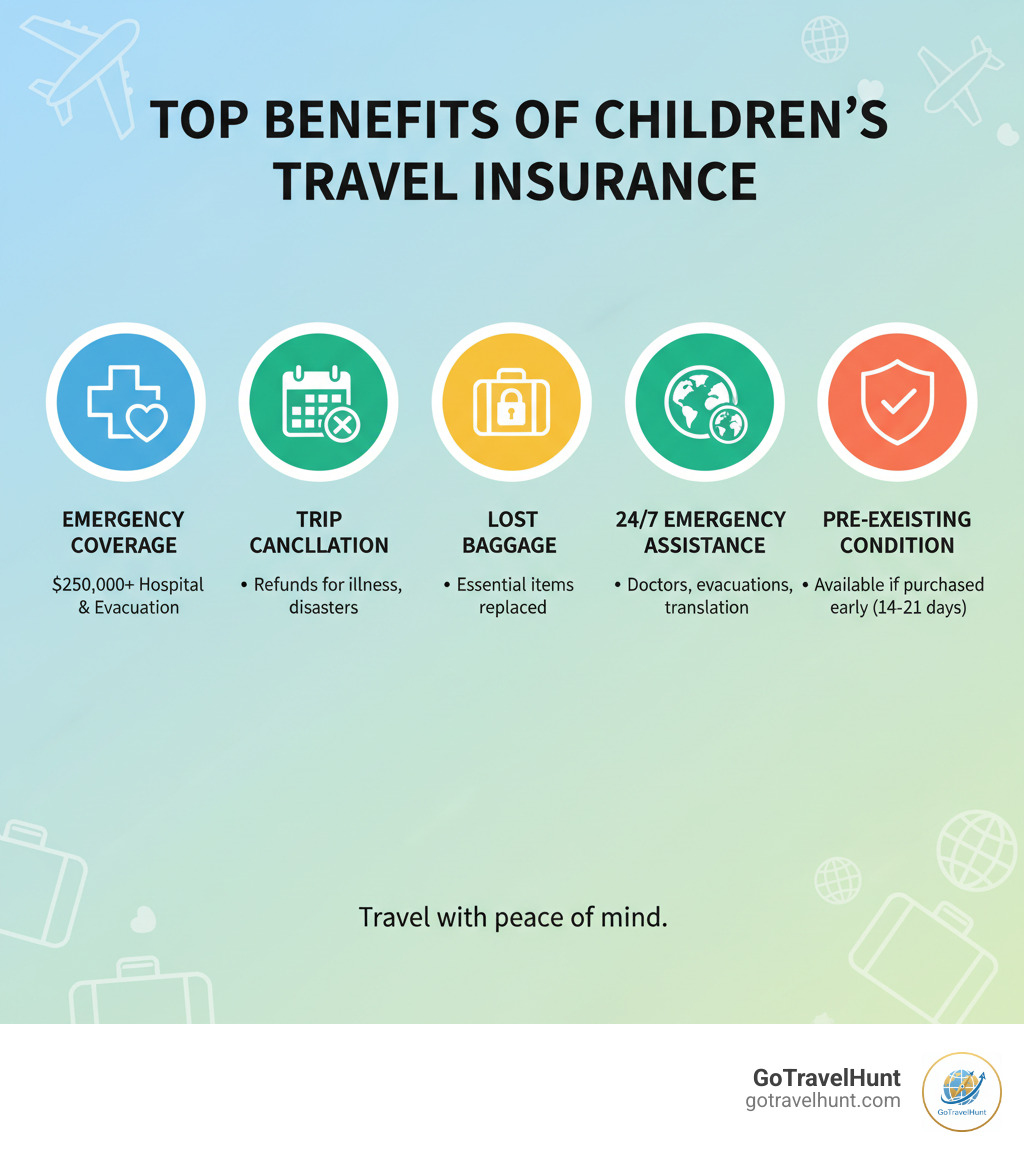

- Coverage typically includes emergency medical care, trip cancellations, lost luggage, and 24/7 assistance.

- Children’s premiums are often lower than adults due to their lower risk profile.

- Key coverage amounts to look for: $100,000+ medical, $250,000+ evacuation.

Most domestic health plans don’t cover international care, which means a child’s hospital visit abroad could cost thousands. A good policy adds a financial safety net for medical care and trip issues.

Kids’ coverage is often affordable—and sometimes free when added to an adult’s policy—making comprehensive protection an easy yes.

I’m Ramy Saber, founder of GoTravelHunt. After years helping families plan, I’ve seen how the right policy turns stress into peace of mind.

Travel insurance for children terms to learn:

- expense savings tips for traveling with your family out west

- family travel tips

- traveling with family

Why Travel Insurance is a Non-Negotiable for Family Trips

You plan the perfect getaway; a sudden illness or accident can upend it. Without travel insurance for children, you risk losing non-refundable costs and facing steep medical bills abroad. Even lost baggage with essentials can derail a trip. Protecting kids protects your whole travel investment. Explore more ways to save via our Budget Travel guides.

The High Cost of Medical Emergencies Abroad

Most domestic health plans treat overseas care as out-of-network, leaving you with large bills. ER visits can cost thousands; medical evacuations can exceed $250,000. Robust policies commonly include $100,000+ in medical and $250,000+ in evacuation coverage—worth it for the peace of mind. Check international road safety information before you go.

Comparing Premiums: Travel Insurance for Children vs. Adults

Children are typically lower risk, so premiums tend to be lower. Many plans include kids free when an adult is insured, or at a discount—especially on family policies. See our Affordable Travel resources to stretch your budget further.

What Does Travel Insurance for Children Cover?

A strong travel insurance for children policy protects health, trip costs, and belongings—and usually includes 24/7 assistance for emergencies abroad.

Emergency Medical and Evacuation

- Medical care: doctor visits, hospital stays, prescriptions. Aim for $100,000+.

- Medical evacuation: transport to better care or home; look for $250,000+ (many offer up to $1M).

- Repatriation: costs to return remains.

Stay safe on the road with this international road safety guide.

Trip Cancellation, Interruption, and Delay

- Cancellation: reimburses prepaid, non-refundable costs for covered reasons (e.g., illness, severe weather).

- Interruption: reimburses unused trip portions and emergency return travel.

- Delay: covers meals/lodging during significant delays.

Before you pack, see our guide on what to pack for international travel.

Baggage and Personal Effects

- Lost/stolen luggage: reimburses to replace essentials.

- Delayed baggage: buys necessities after a set wait (often 6–12 hours).

- Electronics: often covered with item limits; check caps.

How to Choose the Right Policy for Your Family

Finding the right travel insurance for children is about matching coverage to your needs—not just picking the cheapest plan. Read the fine print, verify exclusions (adventure sports, pre-existing conditions), and ensure destinations and activities are covered.

More info about our Travel Planning Guides.

The Benefits of a Family Policy

- One policy for everyone: simpler management and claims.

- Many plans include kids free (often under 17 or 21) with insured adults.

- Consider annual multi-trip if you travel often; single-trip if not.

Key Considerations for Travel Insurance for Children

- Medical limit: at least $100,000; $250,000+ for high-cost destinations.

- Evacuation limit: $250,000 to $1M.

- Pre-existing condition waiver: usually available if purchased within 14–21 days of initial trip payment.

- Adventure/sports riders: add if doing skiing, diving, etc.

- Destination requirements: confirm entry/coverage needs.

- Check age cutoff for free child coverage.

Why Travel Insurance for Children is Essential for Every Family Trip

Travel is unpredictable—kids make it more so. Travel insurance for children covers costly surprises like medical care abroad, cancellations, and lost essentials. Many family plans include kids at no extra cost, and children’s premiums are typically lower than adults. Aim for $100,000+ medical and $250,000+ evacuation coverage.

Why Travel Insurance is a Non-Negotiable for Family Trips

Without travel insurance for children, a last-minute illness or injury can wipe out prepaid costs, and overseas medical bills can be staggering. Policies cover cancellations, emergencies, and even baggage mishaps—vital when kids’ medications or comfort items are involved.

The High Cost of Medical Emergencies Abroad

Most plans treat international care as out-of-network. ER visits can cost thousands; evacuations can reach six figures.

Comparing Premiums: Travel Insurance for Children vs. Adults

Children often cost less to insure, and many policies include them free with insured adults. See Affordable Travel.

What Does Travel Insurance for Children Cover?

Think of travel insurance for children as a three-part safety net: medical emergencies, trip protection, and belongings—plus 24/7 assistance to coordinate care and logistics.

Emergency Medical and Evacuation

- Emergency treatment and hospital costs (target $100,000+).

- Medical evacuation (target $250,000+; many plans up to $1M).

- Repatriation of remains.

For safe driving abroad, review international road safety information.

Trip Cancellation, Interruption, and Delay

- Reimburses non-refundable bookings for covered reasons.

- Covers unused trip portions and emergency return travel.

- Pays for meals/lodging during long delays.

More info about what to pack for international travel.

Baggage and Personal Effects

- Lost/stolen: reimbursement to replace items.

- Delayed bags: essentials after a waiting period.

- Electronics: covered with per-item limits—check caps.

How to Choose the Right Policy for Your Family

Select travel insurance for children by matching coverage to your family’s health needs, destinations, and activities. Read exclusions (pre-existing conditions, adventure sports) and confirm all travelers are listed.

More info about our Travel Planning Guides.

The Benefits of a Family Policy

- Single policy for all travelers.

- Many plans include kids (under 17–21) at no extra cost.

- Consider annual multi-trip for frequent travel.

Key Considerations for Travel Insurance for Children

- Medical: $100,000+ (more for high-cost areas/cruises).

- Evacuation: $250,000–$1M.

- Pre-existing waiver: buy within 14–21 days of initial payment.

- Adventure/sports riders if needed.

- Meets destination/entry requirements.

Why Travel Insurance for Children is Essential for Every Family Trip

Travel insurance for children is affordable protection for medical care abroad, cancellations, and lost luggage. Many family plans include kids free with insured adults. Target $100,000+ in medical coverage and $250,000+ for evacuation.

Travel insurance for children terms to learn:

- expense savings tips for traveling with your family out west

- family travel tips

- traveling with family

Why Travel Insurance is a Non-Negotiable for Family Trips

A child’s illness, injury, or lost essentials can derail your plans and budget. Travel insurance for children covers cancellations, urgent medical care, and baggage issues so you aren’t paying out of pocket.

The High Cost of Medical Emergencies Abroad

International hospital visits and evacuations can be extremely expensive. Strong policies help you avoid massive bills.

Comparing Premiums: Travel Insurance for Children vs. Adults

Kids are often cheaper to insure—and sometimes free—when added to a parent’s plan. Learn more: Affordable Travel.

What Does Travel Insurance for Children Cover?

A solid travel insurance for children policy typically includes:

Emergency Medical and Evacuation

- Medical and dental treatment; hospitalization (aim for $100,000+).

- Medical evacuation (often $250,000–$1M).

- Repatriation of remains.

Trip Cancellation, Interruption, and Delay

- Reimbursement for prepaid, non-refundable costs if you cancel for covered reasons.

- Coverage for cutting a trip short and getting home.

- Meals/lodging during long delays.

More info about what to pack for international travel.

Baggage and Personal Effects

- Lost/stolen bags and delayed baggage essentials.

- Electronics covered up to set limits.

- Typical items: clothing, toiletries, eyewear, travel documents, and kids’ comfort items.

How to Choose the Right Policy for Your Family

Focus on coverage you’ll actually use: strong medical and evacuation limits, clear cancellation terms, and support for your activities/destinations.

More info about our Travel Planning Guides.

The Benefits of a Family Policy

One policy is easier to manage, often includes children at no extra cost, and keeps benefits consistent for everyone.

Key Considerations for Travel Insurance for Children

| Feature | What to Look For |

|---|---|

| Medical Limit | $100,000+ (more for high-cost destinations/cruises) |

| Evacuation Limit | $250,000–$1M |

| Pre-existing Conditions | Waiver if bought within 14–21 days of booking |

| Free Child Coverage | Children under 17–21 included with insured adult |

| Adventure Sports | Add riders for skiing, diving, etc. |

| Destination Requirements | Meets entry and local healthcare needs |

Why Travel Insurance for Children is Essential for Every Family Trip

Kids get sick, plans change, and bags go missing. Travel insurance for children cushions the financial impact with medical, cancellation, and baggage coverage. It’s often low-cost—and sometimes free—when added to an adult policy. Target at least $100,000 medical and $250,000 evacuation.

Travel insurance for children terms to learn:

- expense savings tips for traveling with your family out west

- family travel tips

- traveling with family

Why Travel Insurance is a Non-Negotiable for Family Trips

If your child can’t travel or needs care abroad, costs add up fast. Travel insurance for children helps recover prepaid expenses and pays for emergencies, so you don’t have to. It’s essential protection for every traveler.

The High Cost of Medical Emergencies Abroad

International medical care is expensive; evacuations can be hundreds of thousands.

Comparing Premiums: Travel Insurance for Children vs. Adults

Insuring kids is usually cheaper—and often free with a parent’s policy. Explore Affordable Travel.

What Does Travel Insurance for Children Cover?

Expect protection for medical emergencies, trip disruptions, and baggage—plus 24/7 assistance.

Emergency Medical and Evacuation

- Treatment, hospitalization, and evacuation (aim for $100,000+ medical; $250,000–$1M evacuation).

Trip Cancellation, Interruption, and Delay

- Reimbursement for non-refundable costs, costs to get home, and delay expenses.

Baggage and Personal Effects

- Lost/stolen items and delayed-bag essentials. Electronics covered with limits.

More info about what to pack for international travel.

How to Choose the Right Policy for Your Family

Match coverage to your destinations, activities, and health needs. Verify exclusions and make sure every traveler (including kids) is named on the policy.

More info about our Travel Planning Guides.

The Benefits of a Family Policy

- One policy, simpler claims.

- Many include children (under 17–21) at no extra cost.

- Annual multi-trip can be economical for frequent travelers.

Key Considerations for Travel Insurance for Children

- Medical: $100,000+; Evacuation: $250,000–$1M.

- Pre-existing waiver if bought within 14–21 days of first trip payment.

- Add adventure/sports coverage if needed.

- Ensure coverage meets destination/entry rules.