Travel Insurance Flight Delay: Ultimate Guide 2025

Why Travel Insurance Flight Delay Coverage Matters More Than You Think

Travel insurance flight delay coverage protects you from out-of-pocket expenses when your flight is significantly delayed. Here’s what you need to know:

- What it covers: Meals, accommodation, ground transportation, and communication costs during a covered delay.

- Minimum delay time: Usually 3-12 hours, depending on your policy.

- Common covered reasons: Mechanical issues, severe weather, air traffic control problems, and strikes.

- What you’ll need to claim: Receipts for all expenses, an airline statement confirming the delay, boarding passes, and your original itinerary.

- How it differs: Trip delay covers expenses during a wait; trip cancellation refunds costs if you can’t leave; trip interruption covers costs if you must cut your trip short.

Most travelers will experience a flight delay at some point. Yet many travel without proper coverage, learning the hard way that airline compensation doesn’t always cover the costs of an unexpected wait. A delay of six hours or more can lead to expenses for meals, a hotel room, and transportation. Without trip delay coverage, these costs come straight from your pocket. With the right policy, you can claim reimbursement for reasonable costs incurred during the delay.

Understanding what’s covered is key. Airlines have specific obligations, but these often don’t cover delays outside their control, like severe weather. Travel insurance is designed to fill these gaps, turning a stressful, expensive wait into a manageable inconvenience.

I’m Ramy Saber, founder of GoTravelHunt. I’ve seen how the right travel insurance flight delay coverage can turn a travel disaster into a minor hiccup. Let me walk you through what you need to know to protect your next journey.

Travel insurance flight delay word roundup:

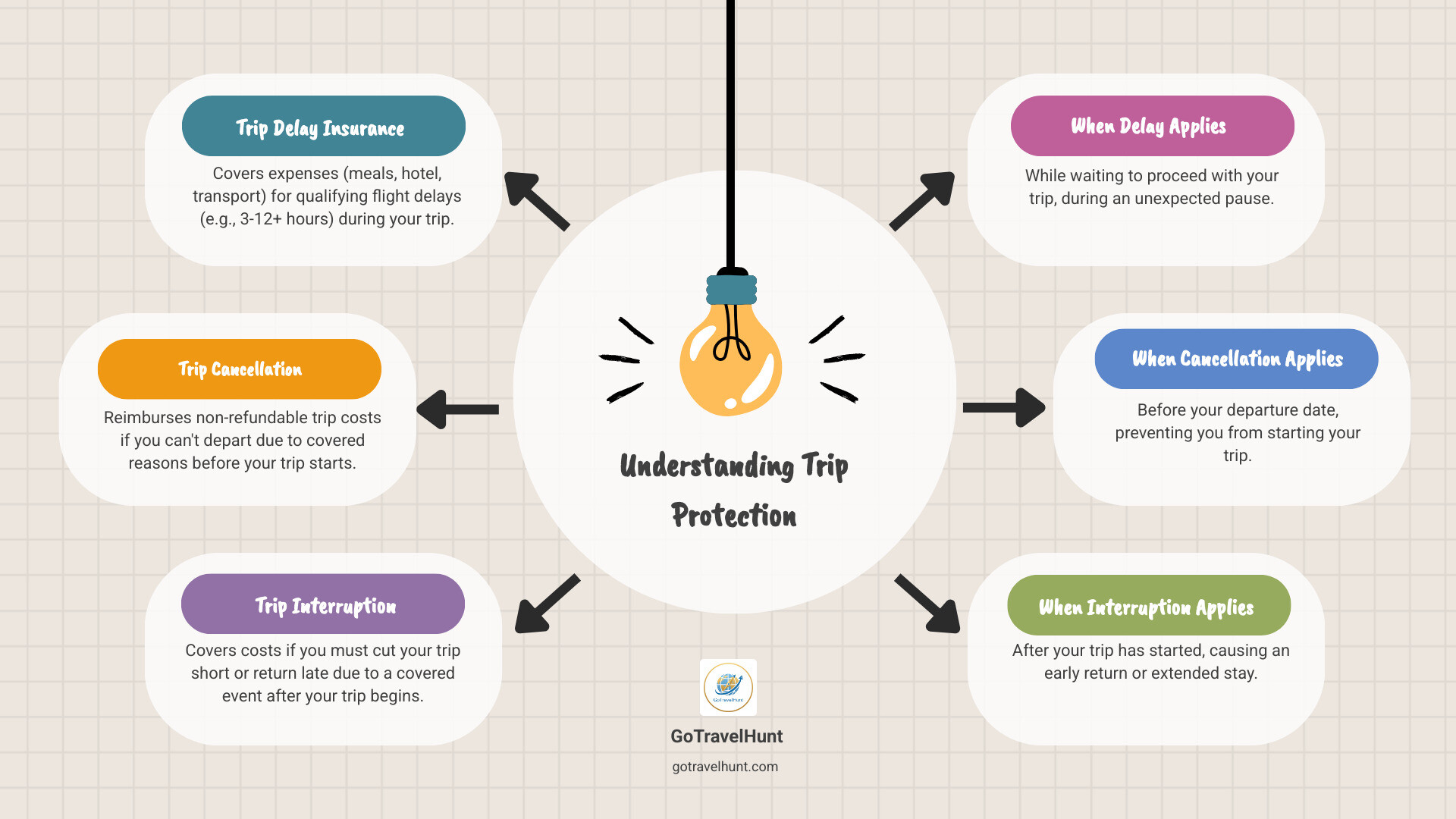

Understanding Trip Delay Insurance vs. Other Coverages

When the airport departure board flashes “DELAYED,” it helps to know what your insurance covers. Travel insurance flight delay is one of three key protections, and it’s often confused with trip cancellation or trip interruption coverage.

Think of them as a timeline: each one applies at a different stage of your journey to create a complete financial safety net. Understanding the difference is crucial. For a deeper dive into pre-departure coverage, see our guide with more info about travel cancellation insurance.

What is Trip Delay Insurance?

Trip delay insurance is your short-term safety net for unexpected pauses in your journey. It’s not for canceling your trip; it’s for managing costs that accumulate while you’re stuck waiting. When your flight is delayed for a covered reason (like weather or mechanical issues) beyond a minimum time (usually 3-12 hours), this coverage reimburses you for reasonable expenses.

This includes costs for meals, a hotel for an overnight delay, toiletries, and communication. You pay for these expenses upfront, keep your receipts, and file a claim for reimbursement later.

How is it Different from Trip Interruption and Cancellation?

These three coverages protect you at different points in your trip. Here’s a simple breakdown:

-

Trip Cancellation: This protects your investment before you leave home. If a covered reason (like a sudden illness or family emergency) prevents you from traveling at all, it reimburses your pre-paid, non-refundable costs like flights, hotels, and tours.

-

Trip Interruption: This applies after your trip has started. If you must cut your trip short to return home early, or if a delay causes you to miss a large portion of a pre-paid tour, this coverage can reimburse you for the unused parts of your trip and extra transportation costs.

-

Travel Insurance Flight Delay: This fits in the middle. Your trip isn’t canceled or cut short—you’re just stuck waiting to continue. It covers the immediate, practical expenses you face during that wait, like food and lodging.

To remember the difference: Cancellation is for when you can’t go, Interruption is for when you have to leave early or get stuck longer, and Delay is for when you’re just waiting to get moving again.

What’s Covered? Decoding Your Trip Delay Benefits

When your flight is delayed, you’ll want to know exactly what expenses your insurance will cover. Travel insurance flight delay benefits are designed to ease the financial sting of these waits, but the specifics depend on your policy’s covered expenses, limits, and minimum delay time.

Common Reimbursable Expenses

Trip delay insurance covers reasonable and necessary expenses you incur because of a covered delay. These typically include:

- Meals and Food: Reimbursement for food and drinks while you wait.

- Hotel or Accommodation: Covers the cost of a hotel room if your delay extends overnight.

- Ground Transportation: Pays for transport like a taxi or shuttle between the airport and your hotel.

- Communication Costs: Covers necessary phone calls or internet access to rearrange plans.

- Essential Toiletries/Personal Items: Reimbursement for necessities if your checked luggage is inaccessible.

Policies have a maximum benefit amount (e.g., up to $500) and often a per-day limit (e.g., $200/day). Always keep your itemized receipts to make a claim.

Covered Reasons for a Flight Delay

Coverage only applies if the delay is for a reason listed in your policy. Common covered reasons include:

- Airline Mechanical Issues: Technical problems with the aircraft.

- Inclement Weather: Severe weather like snowstorms or hurricanes that make flying unsafe. This is a key benefit, as airlines rarely compensate for weather delays.

- Air Traffic Control Problems: System issues, staffing shortages, or airport congestion.

- Strikes Affecting Public Transport: Labor strikes by airline staff or air traffic controllers.

- Lost or Stolen Travel Documents: Delays caused by a lost or stolen passport or visa.

Your insurance is especially valuable for delays outside the airline’s control, where the airline’s obligation to you is minimal.

Understanding the Minimum Delay Requirement

This is a critical detail: benefits don’t begin until your flight has been delayed for a specific minimum time. This “policy trigger” varies by plan:

- Some policies require a delay of only 3 hours.

- A common requirement is 6 hours.

- Others may specify 12 hours or more.

For example, some credit card policies cover delays of 4+ hours up to $500, while certain insurance plans offer lounge access for 3+ hour delays and a hotel for 6+ hour delays. Always check the fine print of your policy to know the exact duration required before coverage kicks in.

Your Action Plan: What to Do When Your Flight is Delayed

When your flight is delayed, a calm and organized response can make all the difference for a successful insurance claim. Follow this action plan to steer the delay and protect your travel insurance flight delay benefits.

Step 1: Immediate Actions at the Airport

Your first priority is to gather information and document the situation.

- Contact the airline: Go to the gate agent or customer service desk. Politely ask for the specific reason for the delay and an estimated new departure time.

- Get it in writing: Ask the airline for a written statement or email confirming the reason and length of the delay. This is crucial for your claim. If they refuse, note the agent’s name, the time, and what you were told.

- Ask about assistance: Airlines often provide meal vouchers or hotel rooms for delays within their control. Accept any assistance offered, as your insurance is typically secondary coverage.

- Document everything: Take photos of the departure board showing the delay. Keep your original boarding pass and save all notifications from the airline. This digital trail is your evidence.

Step 2: Documenting and Tracking Expenses

Proper records are essential for reimbursement. Without receipts, even valid expenses may be denied.

- Keep all itemized receipts: From the moment your delay meets the policy’s minimum time, save every itemized receipt for meals, lodging, transport, and other necessities.

- Check your limits: Be aware of your policy’s daily and total reimbursement limits. Spending beyond these caps will come out of your own pocket.

- Separate expenses: If traveling in a group, keep expenses for each person separate to align with per-person policy limits.

- Note the time: Make sure your receipts show the date and time of purchase to prove the expenses occurred during the qualifying delay period.

Step 3: Filing a Claim for Travel Insurance Flight Delay

Once you’ve arrived, file your claim as soon as possible. Most insurers have a time limit for submissions.

Gather your documentation package, which should include:

- A completed claim form from your insurance provider.

- A statement from the airline verifying the delay’s cause and duration.

- Your original and new flight itineraries and all boarding passes.

- Itemized receipts for all expenses you are claiming.

- Proof of your trip purchase and your travel insurance policy.

A thorough and well-documented claim is processed much faster. By being organized, you can ensure you receive the reimbursement you’re entitled to.

Navigating Airline Rules vs. Your Travel Insurance Flight Delay Coverage

When a flight is delayed, it can be confusing to know who is responsible for what: the airline or your insurance company? The answer depends on the reason for the delay and your location. For a comprehensive overview, refer to A Guide to Flight Delays and Cancellations.

Airline Compensation vs. Insurance Reimbursement

Airlines have obligations to passengers, but they are limited, especially by the cause of the delay.

-

Delays within airline control (e.g., mechanical issues, crew scheduling): Airlines are generally required to provide assistance like food, drinks, and communication. In some regions like Canada and the EU, they must also pay cash compensation for long delays.

-

Delays outside airline control (e.g., severe weather, air traffic control issues): The airline’s duty is usually limited to rebooking you on the next available flight. They are typically not required to provide meals, hotels, or cash compensation.

This is where travel insurance flight delay coverage is essential. It acts as a safety net, covering reasonable expenses like your hotel and meals when the airline is not obligated to. Your insurance is a “second payer” that fills the gaps left by airline policies.

Understanding Passenger Rights in Different Regions

Passenger rights vary significantly around the world.

-

In Canada: The Air Passenger Protection Regulations (APPR) mandate assistance and compensation up to $1,000 from large airlines for long delays within their control.

-

In Europe: Regulation EC 261/2004 provides some of the strongest protections. It requires airlines to provide a “right to care” (meals, accommodation) and compensation from €250 to €600 for delays over three hours, unless caused by “extraordinary circumstances.”

-

In Australia: Australian Consumer Law requires services to be provided in a “reasonable time.” Passengers may be entitled to a refund or replacement for significant delays, but there are no fixed compensation amounts, making travel insurance especially important.

Even with these regulations, your insurance provides critical coverage, especially for uncontrollable delays that regulations don’t cover.

Common Exclusions in Travel Insurance Flight Delay Policies

Trip delay coverage has limitations. Be aware of these common exclusions:

- Short delays: If the delay doesn’t meet your policy’s minimum time requirement (e.g., 6 hours), it won’t be covered.

- Known events: If you buy insurance after a major event (like a hurricane) is already known, delays caused by it will likely be denied.

- Personal reasons: Missing a flight because you overslept or got stuck in traffic is not covered.

- Lack of documentation: Claims without proper receipts or an airline statement will be difficult to prove and may be denied.

- Pre-existing medical conditions: A delay caused by a pre-existing condition may not be covered unless you purchased a specific waiver.

Always read your policy carefully to understand what is and isn’t covered.

Maximizing Your Coverage: Credit Cards, Improved Plans, and Choosing Wisely

Now that you understand how travel insurance flight delay coverage works, let’s ensure you get the best protection. This involves looking at all your options, from the benefits on your credit card to specialized insurance services.

The Role of Credit Card Travel Benefits

Before buying a standalone policy, check your premium credit cards. Many offer automatic trip delay coverage as a perk, but there are conditions. Typically, you must pay for most or all of your trip with that card. The coverage is often more modest than standalone policies, with lower reimbursement caps (e.g., $500) but sometimes shorter delay triggers (e.g., 4 hours).

Credit card benefits can be great for shorter trips or as a supplement to a more comprehensive policy. Always read your card’s benefit guide to understand the specific terms, limits, and exclusions. To see how your card compares, compare holiday insurance with our ultimate guide.

Are Improved Flight Delay Services Worth It?

Some insurers offer proactive flight delay services that reduce stress in real-time. Instead of you filing a claim later, these services monitor your flight and automatically send benefits when a qualifying delay occurs.

For example, a service like Blue Cross’s Flight Delay Service might send you a notification with complimentary airport lounge access for a 3+ hour delay. For a 6+ hour delay, it might provide a pre-arranged hotel room and a cash allowance for meals. The convenience of receiving immediate relief makes these plans worth considering, especially for frequent flyers. They turn reactive reimbursement into proactive care.

How to Choose the Right Policy for Your Trip

Selecting the right policy means matching it to your specific travel plans. Here’s what to consider:

- Trip Complexity: A multi-leg international journey with tight connections needs more robust coverage than a simple direct flight.

- Layover Locations: If you’re connecting through airports known for weather or congestion issues, stronger coverage is a smart investment.

- Policy Details: Read the fine print. What is the minimum delay time? What are the daily and total benefit limits? Are the limits adequate for your destination’s costs?

- Purchase Timing: Buy insurance as soon as you book your trip. This provides the longest period of coverage and is often required for certain benefits, like waivers for pre-existing conditions.

- Destination Regulations: In regions with strong passenger rights (EU, Canada), your insurance fills gaps. In places with fewer specific rules (Australia), it becomes your primary protection.

At GoTravelHunt, we believe the right travel insurance flight delay coverage should fit your trip, budget, and travel style. Take time to compare policies and choose one that lets you travel with confidence.

Frequently Asked Questions about Flight Delay Insurance

What if my delay causes me to miss a cruise or tour?

If a covered flight delay causes you to miss a significant portion of your trip (often 50% or more), your claim may shift from trip delay to trip interruption benefits. This is beneficial, as trip interruption can reimburse you for the pre-paid, non-refundable costs of the trip segments you missed. For example, if a two-day flight delay causes you to miss half of your cruise, trip delay would cover your hotel during the wait, while trip interruption could cover the cost of the missed cruise days. Notify your insurer and travel suppliers as soon as you know your trip will be interrupted.

Does travel insurance cover delays outside of the airline’s control?

Yes, and this is a primary reason to have this coverage. When delays are caused by events like severe weather, natural disasters, or air traffic control issues, airlines are typically not required to provide compensation for meals or hotels. Your travel insurance flight delay benefits are designed to cover these exact situations, reimbursing you for reasonable expenses while you wait for the airline to rebook you on the next available flight. It provides a financial safety net when the airline can’t help.

Do I need to buy insurance from the airline?

No, you are not required to buy insurance from the airline. It is highly recommended that you shop around. While convenient, airline-offered plans are often less comprehensive and may be more expensive than policies from independent providers. Third-party plans frequently offer higher benefit limits, broader coverage for cancellations and interruptions, and better medical protection. Use comparison tools to evaluate policies side-by-side and find the best fit for your trip and budget. Our ultimate guide to comparing holiday insurance can help you get started.

Conclusion

Staring at a delayed departure board is a frustrating but common part of travel. While you can’t prevent delays, you can prevent them from becoming a financial burden. Understanding and having travel insurance flight delay coverage is one of the smartest preparations a traveler can make.

This coverage provides a safety net, reimbursing you for meals, hotels, and other necessities when you’re stuck waiting. It fills the critical gaps where airline compensation falls short, especially for delays caused by weather or other events outside the airline’s control. By knowing the difference between delay, cancellation, and interruption, documenting your expenses, and understanding your rights, you can travel with confidence.

Before your next adventure, take a moment to choose a policy that matches your trip’s complexity and destination. Reading the fine print and comparing your options ensures you have the right protection in place.

At GoTravelHunt, we’re passionate about making travel planning easy and stress-free. We want your journeys filled with amazing memories, not unexpected costs. Before you pack your bags, protect your next trip with the right travel insurance for Australia or wherever your travels take you.

Safe travels!