One way travel insurance: 3 Smart Steps 2025

Why One-Way Travel Insurance Is Essential for Your Journey

One way travel insurance is for travelers without a return ticket, such as those emigrating, backpacking long-term, or on a working holiday. Unlike standard policies that require a round-trip, it covers your outbound journey until you reach your final destination, with durations ranging from weeks to 24 months.

Quick Answer: What You Need to Know

- Who needs it: Emigrants, expats, digital nomads, long-term backpackers, and anyone traveling without a return ticket.

- How it’s different: Covers your outbound journey only; ends upon arrival at your final destination or when the policy expires.

- Maximum duration: Typically 12-24 months, depending on the provider.

- Key coverage: Emergency medical expenses, medical evacuation, baggage loss, and 24/7 assistance.

- Important limitation: Does not cover a flight home if you cut your trip short, as no return ticket was booked.

What makes one-way insurance unique is its focus on the journey rather than a fixed trip. Standard policies often won’t cover travelers moving abroad or on open-ended adventures. One-way policies fill this gap, providing peace of mind for those who value freedom over fixed plans.

As the founder of GoTravelHunt, I’ve helped countless travelers understand one way travel insurance. This guide will walk you through everything you need to compare policies and travel with confidence.

Common *one way travel insurance * vocab:

Understanding One-Way Travel Insurance

Booking a one-way ticket offers unparalleled freedom, but that freedom needs protection. That’s exactly what one way travel insurance is designed to do.

What is one way travel insurance and who needs it?

One-way travel insurance is a safety net for travelers leaving their home country without a return ticket. The policy covers you from departure until you arrive at your final destination. Your coverage ends either when the policy term expires or shortly after you arrive and settle in your new country.

This insurance is essential for:

- Emigrants starting a new life abroad who need coverage until local health insurance is arranged.

- Students studying abroad for a year or more with uncertain return dates.

- Long-term backpackers and digital nomads who have made travel a lifestyle.

- Working holiday makers whose stay depends on their employment.

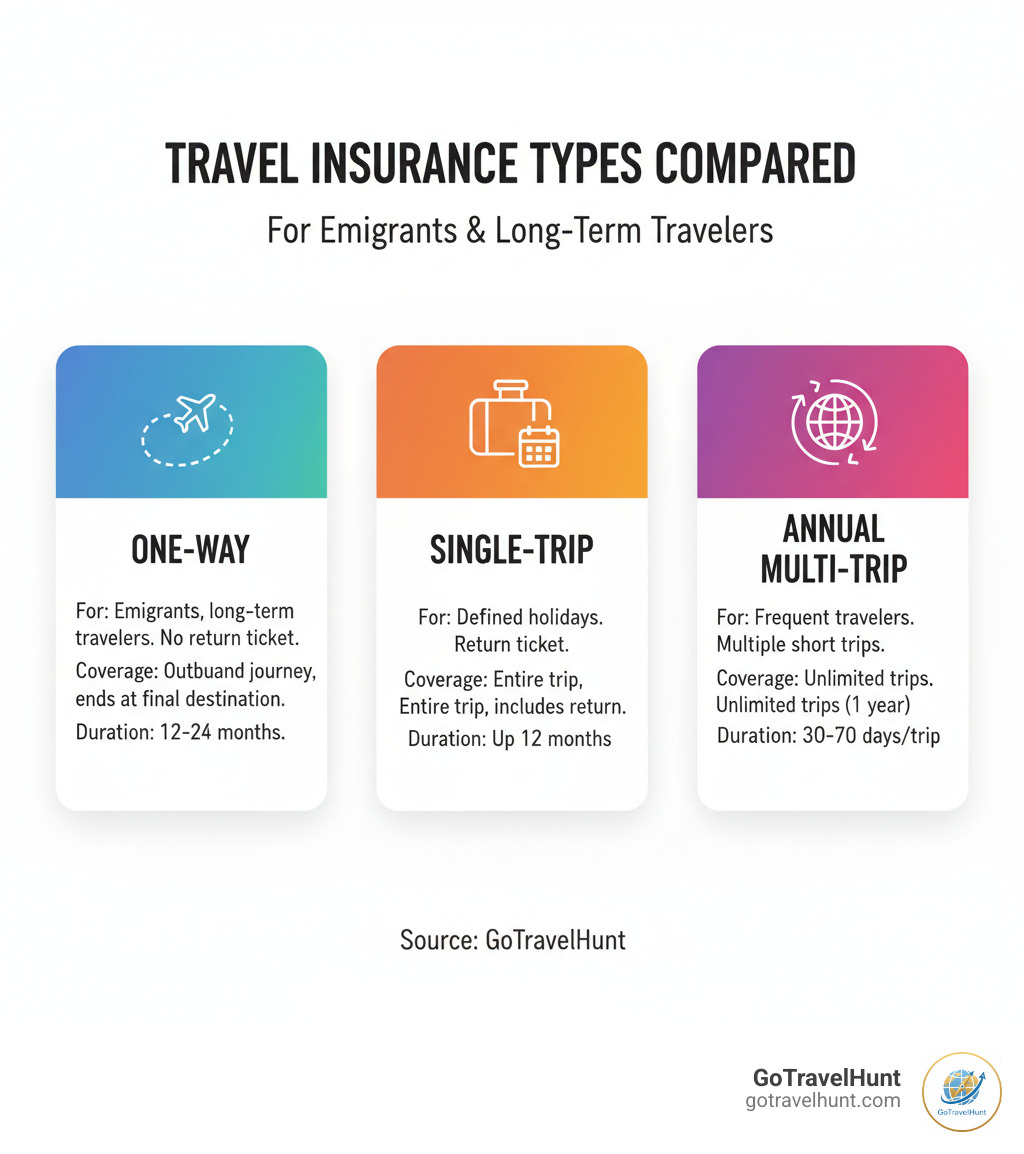

One-Way vs. Single-Trip vs. Annual Policies

Understanding the differences between policy types is key to choosing the right one.

| Feature | One-Way Travel Insurance | Single-Trip Travel Insurance | Annual Multi-Trip Travel Insurance |

|---|---|---|---|

| Trip Type | Emigration, long-term travel, open-ended adventures | Defined holidays, specific journey dates | Multiple short holidays |

| Return Ticket Req. | Not required | Usually required | Required for each individual trip |

| Duration | Few days up to 24 months (typically ends at destination) | Up to 12 months (covers entire period abroad) | Unlimited trips within 12 months, max 30-70 days per trip |

| Best For | Emigrants, expats, digital nomads, long-term backpackers | Occasional travelers, specific vacationers | Frequent travelers, business travelers |

The main difference is the return ticket requirement. Single-trip and annual policies are built for traditional holidays with a defined end. One way travel insurance is for journeys where the end date is flexible.

Key benefits of one way travel insurance

One-way policies offer robust protection for your journey:

- Emergency medical coverage: This is the core of your policy, often covering up to £10 million for hospital stays, doctor visits, and medications. It’s your financial shield against staggering overseas medical bills.

- Medical evacuation: Covers transport to the nearest suitable medical facility, which can be a lifesaver if you’re injured in a remote location.

- Repatriation: Covers costs to return you to your final destination country for medical treatment or, in the tragic event of death, your remains to your home country.

- Baggage loss or delay: Provides compensation for lost, stolen, or delayed luggage so you can replace essentials while you wait.

- Trip cancellation and curtailment: Reimburses prepaid costs if you must cancel before you leave or cut your trip short for a covered reason (e.g., unexpected job loss).

- Personal liability: Protects you financially if you accidentally injure someone or damage their property, with coverage often reaching $100,000.

- 24/7 emergency assistance: A crucial lifeline connecting you to multilingual staff and medical experts who can coordinate care and payment, anytime and anywhere.

What Does a One-Way Policy Actually Cover?

Understanding your one way travel insurance coverage is vital. Let’s break down the protection you’re getting.

Core Medical and Emergency Benefits

This is your financial lifeline for medical emergencies abroad. Policies provide high-level coverage, often up to $10 million or more, for:

- Hospital costs, doctor visits, and prescribed medicines.

- Emergency dental treatment (usually with a specific cap).

- Ambulance services and emergency medical evacuation to a suitable facility.

- Repatriation of remains, which covers the cost of returning your remains home, sparing your family a significant financial burden.

For more details, the Authoritative travel insurance fact sheet from the Canadian government is a great resource. Our More info about travel planning guides can also help you prepare.

Navigating Pre-Existing Medical Conditions

A pre-existing medical condition is any health issue you’ve received treatment or advice for before your policy starts. The look-back period (how far back an insurer checks your history) varies.

The golden rule is to declare everything. Failing to disclose a condition can void your policy and lead to a denied claim. It’s a small effort that can save you from massive medical bills.

Many insurers automatically cover common, stable conditions like well-controlled asthma or diabetes. If your condition isn’t automatically covered, you’ll likely undergo a medical screening, which may result in a higher premium. This extra cost is far better than being uninsured.

Common Exclusions and Limitations

Knowing what isn’t covered is as important as knowing what is. Common exclusions include:

- Change of mind: Deciding you no longer want to travel is not a valid reason for a cancellation claim.

- High-risk activities: Sports like skydiving or ice climbing often require an additional activity pack for coverage. Always check your policy’s list of covered activities.

- Undeclared medical conditions: Claims related to a condition you didn’t disclose will almost certainly be denied.

- Alcohol and drug-related incidents: Injuries or accidents that occur while you are intoxicated are typically not covered.

- Non-emergency treatment: Routine check-ups, ongoing care for stable conditions, and cosmetic procedures are excluded.

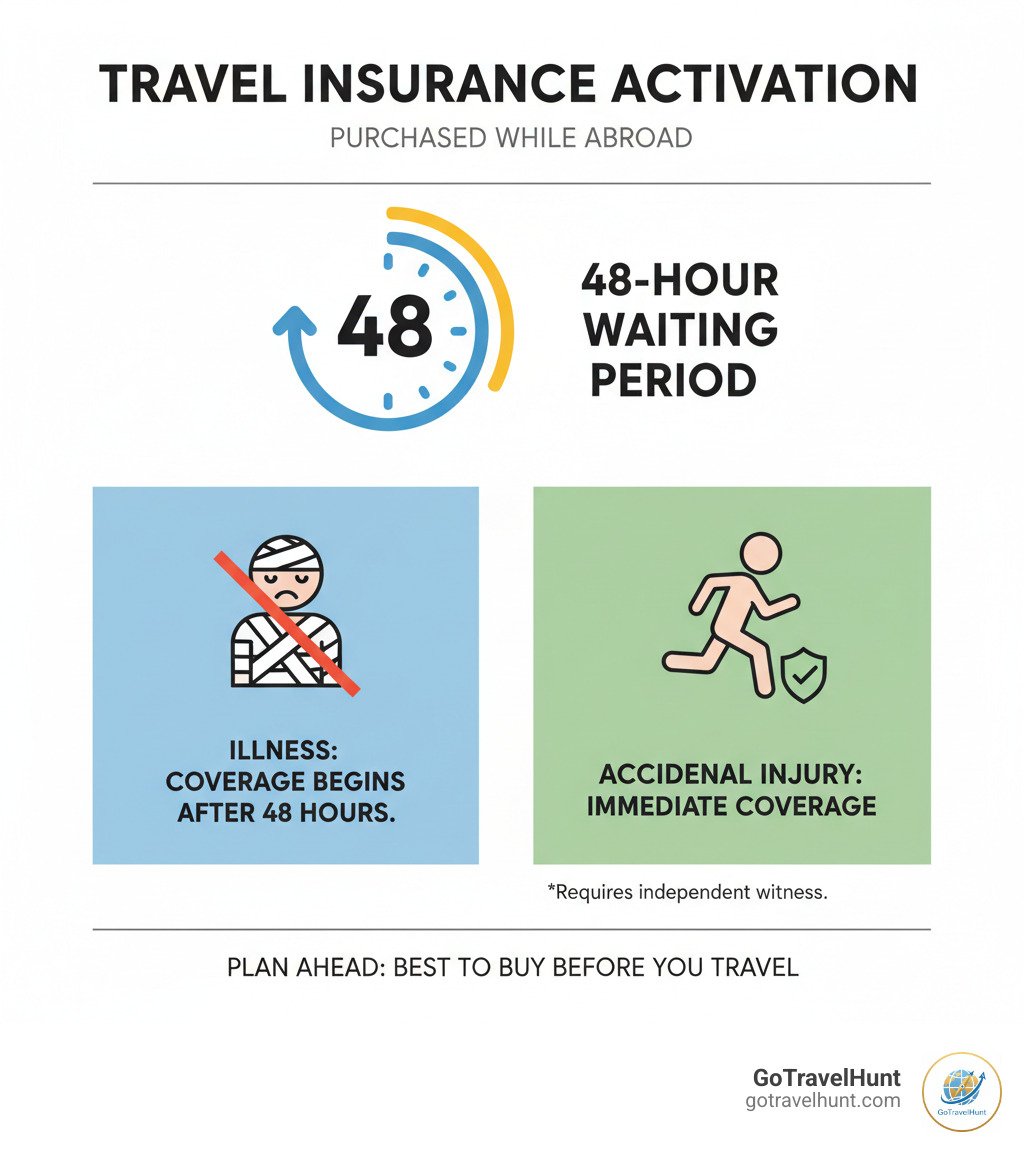

- “Already traveling” waiting periods: Policies bought after departure usually have a 48-hour waiting period for illness coverage. Anything that happened or was developing before you bought the policy is not covered.

Always read your policy wording or Product Disclosure Statement. It’s the contract that defines your coverage. For packing tips to help avoid common issues, see our More info on what to pack guide.

How to Compare and Choose the Best One-Way Travel Insurance

Choosing the right one way travel insurance is simpler when broken down into three steps. This process ensures you find a policy that truly fits your unique journey.

Step 1: Assess Your Trip Details

Before getting quotes, clarify your travel plans. This will help you filter out unsuitable policies.

- Destination(s): Will you be in one country or many? Coverage for regions like the USA and Canada is typically more expensive, so ensure your policy includes them if needed.

- Duration: Estimate how long you’ll be traveling before settling. Choose a policy that matches your timeline or allows for extensions abroad.

- Activities: Will you be working, volunteering, or doing adventure sports? Declare these activities, as some may require an extra “Activity Pack” for coverage (e.g., riding a motorbike over 125cc).

- Value of Belongings: Total the value of your electronics and other important items. Check the policy’s overall and per-item limits for baggage coverage.

- Your Health: Be aware of age limits, which vary by provider. Most importantly, be ready to declare all pre-existing medical conditions accurately.

A travel itinerary template can help you organize these details and ensure you don’t miss anything when comparing policies.

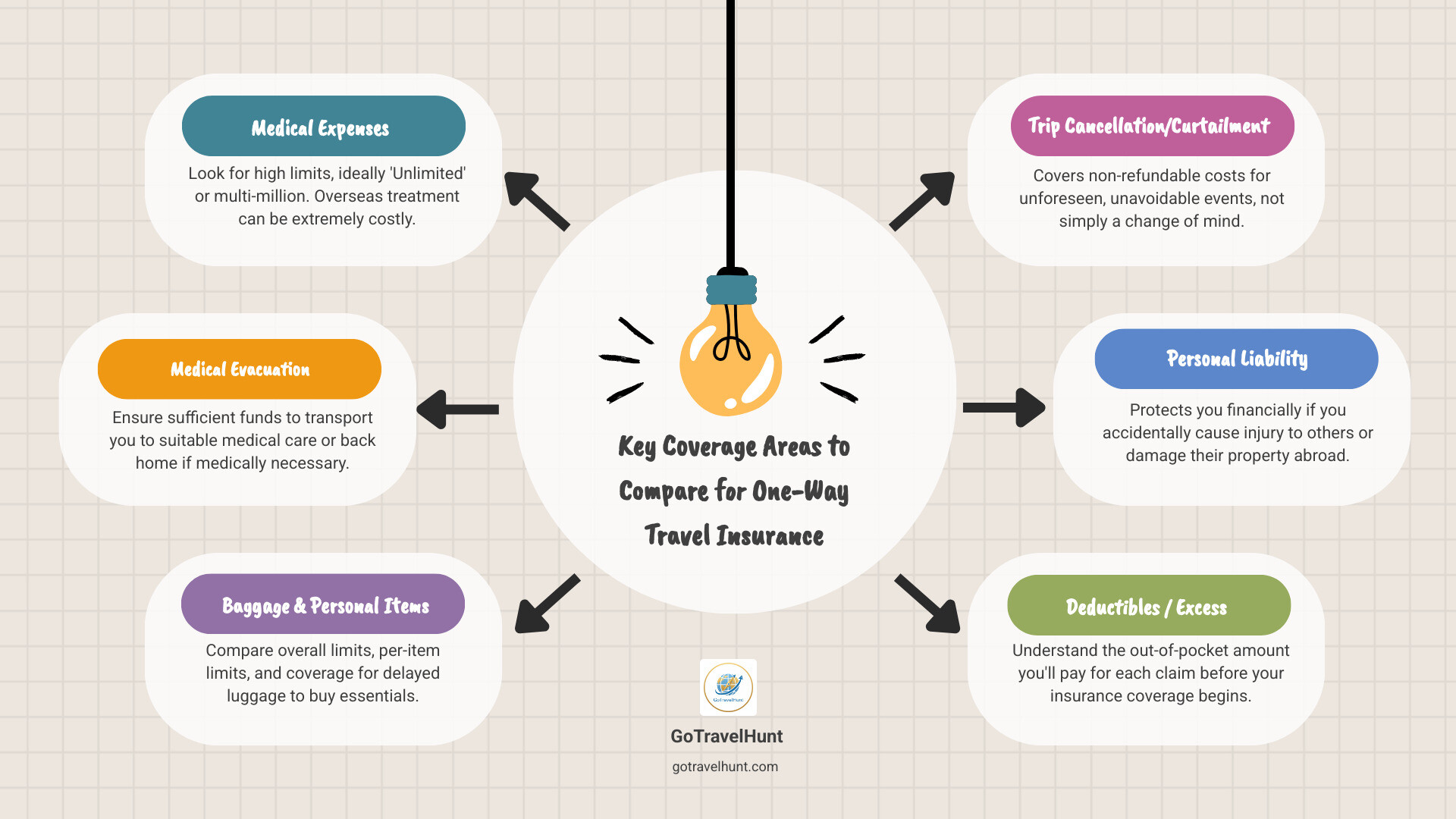

Step 2: Compare Coverage Limits and Deductibles

Once you know your needs, compare the numbers. The cheapest policy is rarely the best value.

- Medical Expenses: Look for at least several million in coverage, if not unlimited. This is not the place to cut corners.

- Medical Evacuation & Repatriation: Ensure this coverage is substantial, especially for remote travel. Check if repatriation is to your final destination or country of origin.

- Baggage: Check the total limit (e.g., $2,500) and the per-item cap (e.g., $500), which may not be enough for a laptop or camera. Baggage delay coverage is also a useful benefit.

- Personal Liability: Aim for at least $100,000 in coverage to protect you if you accidentally cause injury or property damage.

- Deductibles (Excess): This is the amount you pay per claim (e.g., $100). A lower deductible means less out-of-pocket cost, but may increase your premium.

Step 3: Check Provider Reputation and Policy Wording

Before buying, take this final, crucial step.

- Read the Policy Wording: This document (also called a Product Disclosure Statement or PDS) is your contract. It details what is and isn’t covered, defines key terms like “final destination,” and explains the claims process. Spending an hour reading it can save you thousands later.

- Check Provider Reputation: Look for customer reviews, especially regarding the claims process and emergency assistance. A reputable insurer is often underwritten by a large, established group. You can check a provider’s regulatory status to confirm they are legitimate.

- Evaluate the 24/7 Assistance: In an emergency, you need a competent, multilingual support team. Is the helpline staffed by medical professionals? This service is your lifeline abroad.

- Review the Claims Process: Is it straightforward? Look for providers with online portals and clear requirements. A complicated process adds stress when you need it least.

Good insurance is about peace of mind. A reputable provider with a clear policy is worth paying a bit more for.

Practical Guide to Buying and Using Your Policy

Securing your one way travel insurance is more than just a purchase. Understanding the practicalities of cost, duration, and how to get covered if you’ve already left is key to true peace of mind.

How Much Does One-Way Travel Insurance Cost?

There’s no single price for one way travel insurance. The cost depends on several factors:

- Age: Premiums increase for older travelers, who are seen as higher risk.

- Destination: Coverage for countries with expensive healthcare, like the USA and Canada, costs considerably more than for regions like Southeast Asia.

- Trip Duration: A 3-week trip will be cheaper to insure than an 18-month journey.

- Level of Cover: Higher limits for medical, baggage, and liability will increase your premium.

- Optional Add-ons: Extras like gadget cover or activity packs for adventure sports will add to the final price.

Get a personalized quote online to see what you’ll pay. Remember the GoTravelHunt mantra: if you can’t afford travel insurance, you can’t afford to travel.

Policy Duration and Extensions

One-way policies offer flexibility, with durations ranging from a few days up to 12, 18, or even 24 months. This is ideal for travelers with fluid plans.

If your adventure extends, many insurers allow you to extend your policy online before it expires. This is crucial for maintaining continuous coverage. If you let your policy lapse, any new policy purchased while abroad will likely have a waiting period for illness coverage (typically 48 hours). Any condition that develops during the uninsured gap may be considered pre-existing and excluded from future coverage.

Notify your insurer of an extension early through their online portal or by phone to avoid unnecessary stress.

Buying Insurance When You’re Already Abroad

Forgot to buy insurance before you left? Many providers offer “already traveling” policies.

However, there’s a catch: a waiting period. Insurers typically impose a 48-hour rule where any illness that begins during this time is not covered. This prevents people from buying a policy only when they start feeling sick.

Fortunately, accidental injury is often covered immediately from the policy start date. But the most important rule is that you cannot buy insurance to cover an event that has already happened. Insurance protects against future unknowns, not past events.

While it’s possible to get insured mid-trip, it’s always best to arrange your one way travel insurance before you depart for immediate, comprehensive coverage.

Frequently Asked Questions about One-Way Policies

When it comes to one way travel insurance, a few questions come up repeatedly. Here are straight answers to the most common queries.

What happens if I need to be medically repatriated on a one-way policy?

If you become seriously ill or injured, the emergency assistance service will coordinate your care. In most cases, they will arrange repatriation to your final destination country, provided you paid the correct geographical premium. This is a key difference from standard insurance, which sends you back to your country of origin.

However, the medical team has the final say. If they determine it’s medically safer to send you to your home country, they will make that call. Your health is always the top priority.

Does one-way insurance cover my flight home if I cut my trip short?

Generally, no. Since you didn’t have a return ticket booked, the policy isn’t designed to cover the cost of a flight home if you end your trip early. If you must return for a covered reason (like a family emergency), the policy’s curtailment benefits may reimburse you for unused, prepaid costs like accommodation, but you would typically have to purchase your own flight.

Always check your policy’s specific wording on curtailment to understand what is and isn’t covered.

How long does a one-way policy last if I’m emigrating?

Your coverage ends on whichever of these comes first:

- The end date of your policy term (e.g., 12 months).

- Your arrival at your final destination.

Once you arrive in your destination country, coverage typically ceases within 24 to 72 hours after you clear immigration or arrive at your new residence. This short window covers immediate issues, like lost baggage or a minor injury upon arrival.

The policy is designed to cover your transition to a new country, not to act as your long-term health insurance there. It’s crucial to read your policy to understand how it defines “final destination” and when coverage officially ends.

Conclusion

A one-way ticket is the start of an extraordinary adventure. Whether you’re emigrating, backpacking across continents, or simply embracing a life of freedom, that journey deserves proper protection.

One way travel insurance is your safety net, providing peace of mind so you can focus on the experience. It offers comprehensive coverage for medical emergencies, lost baggage, and other unexpected crises, ensuring you’re never navigating them alone or facing financial ruin.

This guide has equipped you with the knowledge to choose the right policy by assessing your trip, comparing coverage, and checking the provider’s reputation. Understanding your insurance is the key to traveling with true freedom.

At GoTravelHunt, we believe in making travel planning easy and stress-free. With the right protection in place, you can focus on what truly matters: the adventure itself.

Ready to take the leap? Start planning your next adventure with the confidence that comes from being properly protected. Safe travels!