Why Travel Insurance Australia is Essential for Every Trip

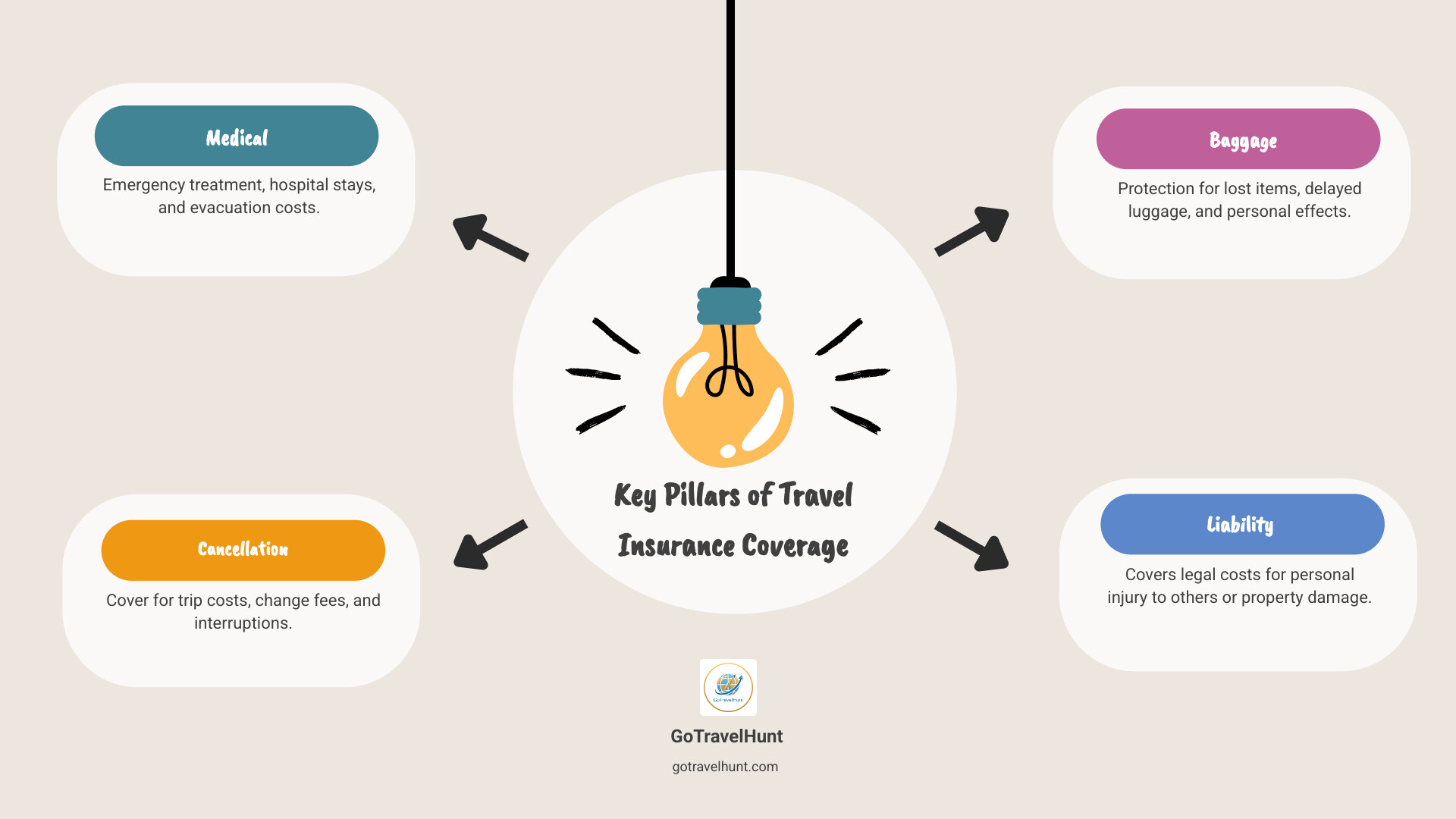

Travel insurance Australia is a crucial safety net that protects you from unexpected medical costs, trip cancellations, lost baggage, and other travel emergencies. Here’s what you need to know:

- Medical emergencies are the top reason to get covered – hospital stays can cost over $3,000 AUD

- Not mandatory for entry, but strongly recommended by the Australian government

- Typical cost is 5-7% of your total trip cost

- Coverage includes medical expenses, trip cancellation, baggage loss, and personal liability

- Must declare pre-existing conditions to avoid claim rejection

- Purchase early for maximum protection, including cancellation cover

Australia is an incredible destination, but travelling without proper coverage can turn a dream holiday into a financial nightmare. A simple broken bone or medical emergency can cost tens of thousands of dollars. Even if you’re visiting from overseas or travelling domestically within Australia, the right policy gives you peace of mind to enjoy everything from the Great Barrier Reef to the Outback without worrying about what-ifs.

The numbers tell the story: At least 574,000 travel insurance claims were made in 2023, totalling £511 million. The average emergency medical treatment claim was £1,724. One traveller’s forest fire injuries resulted in £25,000 in repatriation and medical costs – all covered by their policy.

This guide will walk you through everything you need to know about choosing the right travel insurance for your Australian adventure. We’ll cover what’s included, what’s not, how much it costs, and how to find the best policy for your specific needs.

I’m Ramy Saber, founder of GoTravelHunt, and while my background is in civil engineering and project management, I’ve spent years researching and writing about travel insurance Australia to help travellers make informed decisions. Through GoTravelHunt, I’ve helped thousands of travellers plan stress-free trips with the right protection in place.

Know your travel insurance australia terms:

- business travel booking software

- online booking tools for business travel

- travel booking tools

Why Travel Insurance is a Non-Negotiable for Your Australian Trip

Planning a trip to Australia? Whether you’re dreaming of snorkeling the Great Barrier Reef, exploring Sydney’s iconic harbour, or venturing into the rugged Outback, there’s one thing that needs to be on your packing list before anything else: travel insurance Australia.

We know, we know – insurance isn’t exactly the most exciting part of trip planning. But here’s the thing: it’s absolutely essential. The Australian government doesn’t just suggest it through their Smartraveller service – they’re pretty direct about it. Their advice? “If you can’t afford travel insurance, you can’t afford to travel.” That’s not meant to be harsh; it’s meant to protect you from potentially devastating financial consequences.

Let’s talk numbers for a moment, because they tell an important story. Australia has an excellent healthcare system, but if you’re not a citizen, you’ll be paying full price for every service. A typical hospital stay will set you back around $3,321 AUD – and that’s just for something relatively straightforward. Need surgery? Emergency treatment? Those costs can skyrocket into the tens or hundreds of thousands of dollars.

The statistics from 2023 paint a clear picture. At least 574,000 travel insurance claims were made that year, totalling £511 million. The average emergency medical treatment claim came in at £1,724. But here’s where it gets really eye-opening: one traveller injured in a forest fire racked up £25,000 in repatriation and medical costs. Thankfully, their insurance covered every penny. Without travel insurance Australia, that would have been a life-changing debt.

Medical emergencies aren’t the only reason you need coverage, though. Think about everything you’ve invested in your trip – flights, accommodation, tours, experiences. What happens if a sudden illness forces you to cancel? Or if a natural disaster disrupts your plans? Comprehensive travel insurance Australia protects that investment, reimbursing you for non-refundable costs when the unexpected happens.

Then there’s the hassle of lost or stolen baggage. Picture this: you land in Sydney, excited to start your adventure, only to find your luggage has taken a detour to Perth. Without insurance, you’re buying a new wardrobe out of pocket. With it, you’re covered for essential items and the value of your belongings.

Personal liability coverage is another crucial element that often gets overlooked. Accidents happen – you might accidentally damage someone’s property or cause an injury. This cover protects you from legal costs and compensation payments that could otherwise follow you home.

Before you book anything, we recommend checking the Australian government’s advice on insurance. They provide clear, no-nonsense guidance on why coverage matters and what to look for in a policy.

What is Travel Insurance?

Think of travel insurance Australia as your financial safety net for everything that could possibly go wrong on your trip. It’s a simple contract: you pay a premium, and your insurer agrees to cover specific losses and emergencies outlined in your policy.

The beauty of travel insurance is that it protects you from the moment you book your trip right through until you’re safely back home. It’s not just about medical emergencies, though those are certainly important. It covers a surprisingly wide range of situations that could derail your plans or drain your bank account.

On the medical side, you’re covered for sudden illnesses, accidents, emergency dental work, medical evacuations, and repatriation if needed. But the protection extends far beyond healthcare. Your policy typically includes trip cancellation or interruption if you need to cancel or cut your trip short due to illness, family emergencies, or natural disasters. It covers lost, stolen, or damaged baggage and personal belongings – essential when you’re thousands of miles from home.

Travel delays and missed connections are covered too, along with rental vehicle excess if you’re planning a road trip along the Great Ocean Road. And that personal liability coverage we mentioned? It protects you if you accidentally cause injury to someone else or damage their property.

Essentially, it’s your peace-of-mind package. Instead of worrying about what could go wrong, you can focus on enjoying Australia’s incredible beaches, wildlife, and landscapes.

Do I Need Travel Insurance to Visit Australia?

Here’s the straightforward answer: travel insurance Australia is not technically required to enter the country. You won’t be asked to show proof of insurance at the border, and it’s not a visa requirement for most visitors.

But let’s be crystal clear about something – just because it’s not mandatory doesn’t mean you should skip it. The Australian government, immigration authorities, and pretty much every travel expert on the planet (including us) strongly recommend you get comprehensive coverage before you go.

Some countries have Reciprocal Health Care Agreements with Australia – if you’re from the UK or New Zealand, for example, you might think you’re covered. But here’s the catch: these agreements typically only cover medically necessary treatment in public hospitals. They don’t cover ambulance services (which can cost hundreds of dollars), dental care, repatriation, or any of the non-medical emergencies we’ve discussed. You’d still be personally responsible for those costs.

Travelling uninsured to Australia is taking a massive financial gamble. If you have a serious medical emergency without coverage, you’re personally responsible for every dollar. We’re talking potentially hundreds of thousands of dollars. Some people have been unable to leave the country until their medical bills were paid. Others have faced bankruptcy. One broken leg or serious illness can turn your dream holiday into a financial nightmare that follows you for years.

The cost of a good policy is usually just 5-7% of your total trip cost – a small price for protection against catastrophic expenses. When you consider what’s at stake, travel insurance Australia isn’t optional. It’s the foundation of responsible travel planning.

Decoding Your Coverage: What’s Included and What’s Not

Understanding what our travel insurance Australia policy covers – and just as importantly, what it doesn’t – is crucial to travelling with true peace of mind. Policies aren’t one-size-fits-all, and the devil, as they say, is in the details (specifically, the Product Disclosure Statement, or PDS). Let’s break down what we can typically expect from a comprehensive policy, what’s usually excluded, and the different types of policies available to suit our unique travel style.

Standard Inclusions in a Comprehensive Policy

When we invest in a comprehensive travel insurance Australia policy, we’re essentially buying ourselves broad protection against life’s little (and big) surprises. While the exact benefits vary between providers, here’s what we can typically expect to find included in a good comprehensive plan.

The star of the show is usually unlimited overseas medical cover. Many Australian providers, like Fast Cover and Australia Post, offer unlimited coverage for emergency medical and hospital expenses overseas. This is genuinely the biggest ticket item and the primary reason most of us get insurance in the first place. It includes doctor’s visits, hospital stays, prescribed medication, and even emergency dental work if we crack a tooth on a pavlova in Perth.

Emergency medical evacuation and repatriation is another crucial inclusion. If we fall seriously ill or get injured in a remote area, or need highly specialised treatment that’s not available locally, our policy should cover the cost of transporting us to a suitable medical facility – or even back home to Australia. Without insurance, this alone can cost tens of thousands of dollars.

Trip cancellation and interruption cover protects our financial investment in the trip. If we have to cancel before we leave, or cut our adventure short after we’ve started, due to unforeseen circumstances like our own illness, injury, or a family emergency, this benefit reimburses our non-refundable costs. Some policies, like Fast Cover, even offer unlimited trip cancellation cover.

Our luggage and personal effects are also typically covered if they’re lost, stolen, or damaged. Cover-More offers up to $25,000 for luggage on their comprehensive+ plan, while 1Cover offers up to $15,000, and Australia Post up to $12,000. Just be aware of single item limits, which can be lower for electronics or valuables – our brand new laptop might not be fully covered under a standard policy.

Most comprehensive policies automatically include rental vehicle excess cover, which can save us from buying expensive extra insurance from the car rental company itself. If our rental car is damaged or stolen, this benefit covers the excess we’d otherwise have to pay out of pocket.

Travel delays and missed connections are also usually covered. If our flight is delayed for a significant period (often 6-12 hours), the policy may cover additional accommodation, meals, or other expenses we incur while waiting.

Finally, personal liability cover protects us if we accidentally injure someone or damage their property while overseas. Many comprehensive policies offer up to $5,000,000 in personal liability cover, which can be a lifesaver if we’re found legally responsible for someone else’s medical bills or property repairs.

Common Exclusions to Be Aware Of

While comprehensive policies offer broad protection, no travel insurance Australia policy covers absolutely everything. Understanding these common exclusions is just as important as knowing what’s included – ignorance here could cost us dearly.

The biggest trap is undeclared pre-existing medical conditions. If we have a pre-existing condition and don’t declare it during the application process, any claims related to that condition will almost certainly be denied. Even if we think our condition is minor or well-controlled, we need to declare it. Honesty truly is the best policy here.

Most standard policies exclude high-risk adventure sports unless we specifically add them to our cover. Activities like bungee jumping, skydiving, whitewater rafting, or even certain types of scuba diving or skiing aren’t automatically covered. If we’re planning an adrenaline-fueled adventure, we’ll likely need to purchase an “adventure pack” or specific add-on cover.

Incidents under the influence are another common exclusion. If we suffer an injury or incident while under the influence of alcohol or non-prescribed drugs, our claim will almost certainly be denied. Insurers aren’t big fans of vodka-fueled misadventures, no matter how much fun they seemed at the time.

Travelling against government advice can also void our policy. If the Australian government (via smartraveller.gov.au) issues a “Do Not Travel” warning for a destination, our policy will likely be void for that region. Some policies may also be affected by Level 3 “Reconsider Your Need to Travel” warnings. We should always check travel advisories here before and during our trip.

Unattended baggage is a surprisingly common reason for denied claims. Leaving our bag unattended in a public place, even for just a moment to grab a coffee, can result in a rejected claim if it’s stolen. The lesson? Keep our belongings close at all times.

Other standard exclusions include illegal activities (engaging in any unlawful activities will void our cover) and lack of due care (if we act recklessly or don’t take reasonable steps to protect ourselves or our belongings, claims may be denied).

The golden rule? Always, always, always read the Product Disclosure Statement (PDS) carefully. It’s not the most thrilling read, but it’s our ultimate guide to what’s covered and what’s not. No surprises, no disappointments.

Types of Policies and Specialised Cover

When it comes to travel insurance Australia, we have several main types of policies to choose from, each designed for different travel styles and budgets.

Basic policies are the most affordable option, covering essential medical emergencies, basic travel delays, and personal liability. They’re a good choice for short, low-risk trips where we just need the bare minimum protection. However, they typically have lower benefit limits and fewer inclusions than comprehensive plans.

Comprehensive policies are the most popular choice, and for good reason. They cover a broad range of events including unlimited overseas medical expenses, emergency repatriation, trip cancellation and interruption, luggage and personal effects, rental vehicle excess, travel delays, personal liability, and often include some COVID-19 benefits. These policies usually have higher benefit limits and offer the best overall protection for our investment.

Annual Multi-Trip policies are perfect for frequent travellers. Instead of buying separate policies for each trip, we pay one annual premium that covers unlimited trips within a 12-month period (usually with a maximum trip length of 30-60 days per trip). This can be significantly more cost-effective if we’re planning multiple adventures throughout the year.

Beyond these main types, we also have access to specialized insurance plans to ensure every traveller’s unique needs are met.

Domestic travel insurance is important even for trips within Australia. Things can still go wrong on home soil! This covers medical emergencies (if we’re outside our home state), trip cancellations, lost luggage, and rental vehicle excess for travel within Australia.

If we’re planning a cruise of two nights or more, we’ll need cruise cover. This is crucial because doctors on cruise ships generally don’t have Medicare provider numbers, meaning our standard Medicare or private health insurance won’t cover onboard medical costs, even in Australian waters. Providers like Cover-More and Fast Cover offer specific cruise add-ons.

For those planning to hit the slopes in the Australian Alps, ski and snow sports cover is essential. It covers potential injuries, lost or damaged equipment, and sometimes even piste closure. Just be aware that activities like ski racing, acrobatics, or off-piste skiing might still be excluded unless specifically added.

Adventure activities cover is a must for thrill-seekers. Many insurers offer specific cover for activities like scuba diving, surfing, or hiking. Cover-More, for example, states they cover over 80 activities in their base plans. Always check if our planned activity is included or requires an extra premium.

Finally, seniors travel insurance ensures that older travellers are properly covered. Many providers cater to travellers up to 99 years old (Cover-More and Fast Cover are examples). However, premiums might be higher, and there might be more extensive medical assessments required.

We’ve covered a lot of ground here, and we know it can seem overwhelming. But remember, the goal is to find a policy that fits our specific adventure, ensuring we’re protected against the unexpected. More info about our Travel Planning Guides can help us dive even deeper into tailoring our perfect Australian trip.

Finding the Right Policy: A Guide to Travel Insurance Australia

Choosing the right travel insurance Australia policy doesn’t have to feel overwhelming. Think of it as finding the perfect travel companion—one that protects you without weighing you down or emptying your wallet. The secret is knowing what to look for and being honest about what you actually need.

We’ve all been tempted by the cheapest option on the comparison site, but here’s the thing: a policy that saves you £20 upfront could leave you facing thousands in bills if something goes wrong. On the flip side, paying for bells and whistles you’ll never use is just throwing money away. Smart shopping means finding that sweet spot between comprehensive protection and reasonable cost.

Your Product Disclosure Statement (PDS) is your new best friend. Yes, it’s about as exciting as reading the phone book, but this document tells you exactly what you’re buying. It’s where you’ll find whether your surfboard damage is covered, what counts as “unattended baggage,” and how long your flight needs to be delayed before you can claim. Take the time to read it—future you will be grateful.

Your perfect policy depends entirely on your situation. A 25-year-old backpacker needs something completely different from a 65-year-old couple on a luxury cruise. Your health, your activities, your age, and your travel style all shape what coverage makes sense. This is why we always recommend comparing policies and really thinking about what could go wrong on your specific trip. More info about our Travel Planning Guides can help you think through these details.

Factors That Influence the Cost of Your Policy

The price tag on your travel insurance Australia isn’t random—insurers calculate it based on how risky you are to cover. Understanding these factors helps you make smart choices about where to save money and where to invest in better protection.

Your destination matters, even though we’re focusing on Australia. Australian healthcare is world-class but expensive for tourists, which makes it a higher-risk destination than you might expect. How long you’re away also plays a big role—two weeks costs less to insure than two months, simply because there’s more time for things to go wrong.

Age is one of the biggest factors. As we get older, medical issues become more likely, and premiums reflect that reality. The good news is that many providers, like Cover-More and Fast Cover, offer policies for travellers up to 99 years old. You’ll pay more, but you won’t be left without options.

Your level of cover makes a huge difference too. A basic policy covering just medical emergencies costs less than a comprehensive one that includes cancellation, baggage, and all the extras. Think about what you can afford to lose versus what would be financially devastating.

If you have pre-existing medical conditions, expect your premium to increase—or you might need a specialised policy altogether. The activities you’re planning matter too. That scuba diving certification or ski trip? They’ll need add-on cover. And here’s a money-saving tip: choosing a higher excess amount (what you pay before the insurer kicks in) can lower your premium. Just make sure you can actually afford that excess if you need to claim.

As a general rule, travel insurance Australia typically costs between 5-7% of your total trip cost. If your holiday costs £1,000, budget around £50-£70 for insurance. That might seem like an extra expense when you’re already stretching your budget, but compare it to the alternative: a single hospital stay in Australia can cost over $3,000 AUD, and that’s just the beginning.

Navigating Pre-Existing Medical Conditions

Having a pre-existing medical condition doesn’t mean you can’t travel—it just means you need to be extra careful with your travel insurance Australia. This is one area where cutting corners or being less than completely honest can come back to haunt you in a major way.

First, let’s clear up what we mean by pre-existing medical condition. It varies slightly between insurers, but generally includes any medical condition (physical or mental) you’ve received diagnosis, treatment, medication, or advice for in the past 12-24 months before buying your policy. Even if you think it’s minor or completely under control, it counts.

Here’s the golden rule: declare everything. We can’t stress this enough. If you don’t declare a condition and then need to claim for something related to it, your insurer can void your entire policy. Not just deny that one claim—cancel everything. You could be left stranded overseas with no coverage at all. It’s simply not worth the gamble.

The good news is that many conditions are automatically covered at no extra cost. For example, 1Cover automatically covers 35 common pre-existing medical conditions for free, as long as they meet certain stability criteria (like no recent hospitalizations or planned surgeries). Always check your insurer’s list of automatically covered conditions.

For conditions that aren’t automatically covered, most major providers offer online medical assessments during the quote process. You’ll answer questions about your condition, and the system will either approve cover (sometimes with an extra premium), send you for manual review, or let you know they can’t cover you. It’s quick and gives you an immediate answer.

If you have a complex or severe condition and standard insurers can’t help, don’t give up. There are specialist insurers who focus specifically on travellers with challenging medical histories. Find specialist providers via MoneyHelper if you’re having trouble finding suitable coverage. Your condition shouldn’t stop you from seeing the world—but proper coverage is absolutely essential.

COVID-19 and Your travel insurance australia policy

COVID-19 has permanently changed how we think about travel insurance, and most travel insurance Australia policies have adapted to include some level of pandemic coverage. But “some level” is doing a lot of work in that sentence—the details vary wildly between providers, so pay close attention.

The big one is cover for overseas medical expenses if you contract COVID-19 while travelling. Most reputable comprehensive policies now include this, which is crucial given Australia’s sky-high healthcare costs for tourists. Providers like Cover-More, Fast Cover, 1Cover, and Australia Post have all confirmed this coverage for policies purchased after specific dates (1Cover, for instance, includes it for policies bought after November 19, 2021).

Many policies also cover trip cancellation or interruption if you’re diagnosed with COVID-19 before or during your journey. This can help you recoup non-refundable costs if you’re too sick to travel or need to isolate. Fast Cover offers unlimited trip cancellation cover with COVID-19 benefits, which provides serious peace of mind.

If you’re diagnosed overseas and deemed unfit to travel, some insurers (like Fast Cover and Australia Post) will cover additional accommodation and transport expenses during your recovery or isolation period. Imagine being stuck in a hotel for two weeks while you recover—that’s expensive, and this coverage can be a lifesaver.

Here’s where it gets tricky: some insurers have vaccination requirements built into their eligibility criteria. Fast Cover, for example, currently requires travellers aged 18 or older to have had two or more COVID-19 vaccinations (unless medically exempt) and not have tested positive or experienced symptoms in the past 7 days. Check the Recognised vaccines by the TGA for the list of vaccines recognised by the Australian government.

COVID-19 considerations are now a permanent part of travel planning. Always read your PDS carefully to understand exactly what’s covered—medical expenses, cancellation, and additional costs all have different terms and conditions. The pandemic taught us that travel plans can change in an instant, and having the right coverage makes all the difference between a manageable inconvenience and a financial disaster.

Practicalities and Preparedness: Claims, Visas, and Safety

Securing the right travel insurance Australia is just the first step in our journey. Knowing how to actually use our policy when things go wrong, understanding what we need to enter the country, and staying safe while we’re there – these are the practical pieces that turn our insurance from a piece of paper into genuine peace of mind.

How to Make a Travel Insurance Claim

Let’s be honest – making an insurance claim is never fun. We’re usually stressed, possibly unwell, and dealing with an unexpected situation. But if we know what to do and we’ve kept good records, the process doesn’t have to be overwhelming.

The moment something serious happens – especially a medical emergency – our first call should be to the 24/7 emergency assistance line that comes with most comprehensive policies. These aren’t just call centres. They’re staffed by people who can arrange medical care, guarantee payments directly to hospitals, and coordinate emergency evacuations if needed. For major incidents, don’t wait until we’re back home to sort it out. These teams are there to help us right when we need them most.

Documentation is where claims live or die, so we need to become obsessive record-keepers from the moment something goes wrong. If anything is stolen, we must report it to the local police within 24 hours and get a written police report. Without that report, our claim for stolen items will almost certainly be denied. For medical issues, we need doctor’s reports, diagnoses, treatment notes, hospital bills, and pharmacy receipts – everything that shows what happened and what it cost.

For any expense we want to claim – whether it’s emergency clothes because our luggage went missing, extra accommodation due to a flight cancellation, or cancelled tours – we need to keep every single receipt. For lost or damaged valuables, proof of ownership helps tremendously. Original purchase receipts are ideal, but credit card statements or even photos of us using the item can help substantiate our claim.

Most modern insurers make submitting claims surprisingly straightforward. Many offer online claims portals where we can upload documents and track our claim’s progress from anywhere in the world. Example of an online claims tool shows how user-friendly these systems have become.

One crucial detail we can’t overlook is timing. Most insurers have strict deadlines for submitting claims – often around 60 days after returning home. Miss that deadline, and we might lose our right to claim entirely, no matter how legitimate our case.

Key considerations for your travel insurance australia policy

Beyond the policy itself, there are practical matters that intertwine with our travel insurance Australia coverage to ensure a smooth trip.

Our passport needs to be valid for at least six months beyond our planned stay. For most visitors – including Canadians and Europeans – Australia doesn’t require a traditional visa for short tourist visits, but we do need an Electronic Travel Authority (ETA). This electronic authorisation links to our passport and must be arranged before we leave home. While it’s not directly connected to our insurance, having our documentation sorted prevents entry issues that could derail our trip before it starts.

Once we’ve purchased our policy, we need to make those details genuinely accessible. Save our policy number, emergency contact numbers, and a summary of benefits in multiple places – on our phone, in cloud storage, and as physical printouts. It’s also wise to share copies with someone back home. If our phone dies or gets stolen, we’ll be grateful for the redundancy. Explore our Travel Booking Tools to help keep all our travel documents, flights, accommodation, and insurance details organised in one convenient place.

Top Safety Tips for Your Australian Adventure

Our travel insurance Australia policy is our safety net, but prevention beats making a claim every time. Australia is generally safe and welcoming, but like anywhere, a bit of local knowledge goes a long way.

First things first: memorise 000. That’s Australia’s emergency number for police, fire, or ambulance – their equivalent of 911 or 999. Hopefully we’ll never need it, but know.

Australia’s beaches are stunning, but they demand respect. The golden rule is simple: swim between the red and yellow flags where lifeguards patrol. Those flags aren’t suggestions – they mark the safest swimming areas. Rip currents are the real danger here, and they’re not always obvious. If we get caught in one, the key is not to panic or fight it. Swim parallel to the shore until we’re out of the current, then head back to land. In tropical northern waters during certain seasons, marine stingers (jellyfish) can be a serious hazard. If stinger suits are recommended, wear them. It’s not worth the risk.

Yes, Australia has some unique wildlife, and some of it can be dangerous. When hiking or exploring natural areas, we need to watch where we put our hands and feet – snakes and spiders prefer to avoid us, but they will defend themselves if surprised. In northern Australia, crocodile warning signs around waterways aren’t decorative – they’re there because crocodiles genuinely live in those waters. While shark attacks are extremely rare, it’s worth being aware of local safety advice, especially when surfing or swimming in open ocean.

The Australian sun is no joke. It’s genuinely more intense than most of us are used to, and sunburn happens fast. The local mantra is “Slip, Slop, Slap, Seek, Slide” – slip on a shirt, slop on sunscreen (SPF 30 or higher), slap on a hat, seek shade during peak hours, and slide on sunglasses. We need to reapply sunscreen regularly and drink plenty of water. Dehydration and heatstroke are real risks, especially if we’re active outdoors.

If we’re venturing into the Outback, preparation becomes critical. Never go alone. Travel with experienced guides, ensure our vehicle is reliable and well-maintained, carry far more water than we think we’ll need, and always tell someone our itinerary. Mobile phone coverage can be non-existent for hundreds of kilometres, so self-sufficiency matters.

While Australia has low crime rates overall, petty theft can happen, especially in tourist areas. Keep valuables secure, don’t leave bags unattended, and avoid isolated areas late at night. Basic common sense goes a long way.

For those seeking unique adventures, Discover amazing Solo Travel Destinations where personal safety awareness becomes even more important. By following these guidelines and staying alert, we can minimise risks and focus on enjoying everything Australia has to offer.

Frequently Asked Questions about Travel Insurance in Australia

We know you’ve got questions, and we’re here to answer them! Here are some of the most common queries we hear about travel insurance Australia.

How much does travel insurance for Australia typically cost?

The cost of travel insurance Australia is highly variable, but as a general rule, we can expect it to range between 5-7% of our total trip cost. This is an estimate, as the final price will depend on several factors:

- Our Age: Generally, the older we are, the higher the premium.

- Trip Length: Longer trips mean more days of potential risk, so they cost more.

- Level of Cover: A basic policy will be cheaper than a comprehensive one with higher benefit limits and more inclusions.

- Activities Planned: If we add on cover for adventure sports, cruising, or skiing, the price will increase.

- Pre-Existing Medical Conditions: Declaring these can lead to higher premiums or require a specialist policy.

- Excess Amount: Choosing a higher excess (the amount we pay first in a claim) can lower the initial premium.

For example, a basic policy for a young traveller for a week in Europe could be as low as £6.25, but for a comprehensive policy to Australia with specific add-ons and for an older traveller, it will be significantly more. It’s always best to get a personalised quote.

Can I get travel insurance if I’m already in Australia?

Yes, it is possible to get travel insurance Australia if we’re already overseas, or in this case, already in Australia, but it’s generally not ideal. Some insurers, like 1Cover and Fast Cover, offer “already overseas” or “currently travelling” policies. However, there are usually specific conditions:

- Waiting Period: Most “already overseas” policies come with a waiting period (e.g., 48 or 72 hours) before cover actually begins. This means we won’t be covered for any incidents that occur during this initial period.

- Limited Coverage: The cover might be less comprehensive than if we had purchased it before departure.

- Higher Premiums: These policies can sometimes be more expensive due to the increased risk for the insurer.

- Eligibility: There might be restrictions on how long we’ve already been travelling or our residency status.

While it’s a good option if we forgot or our initial policy expired, it’s always best practice to purchase our travel insurance Australia before we even leave home. This ensures we have immediate, comprehensive cover from the moment our trip investment begins.

Does travel insurance cover specific activities like scuba diving or bungee jumping?

This is a fantastic question, and the answer is usually: not automatically under a standard policy. Many exciting activities we might want to try in Australia, like scuba diving (especially beyond a certain depth), bungee jumping, whitewater rafting, or even certain types of hiking or cycling, are considered “high-risk” by insurers.

- Standard policies may not: Our basic or even comprehensive policy will likely exclude cover for injuries or incidents arising from these adventure activities.

- Adventure Add-on Pack: To be covered, we often need to purchase an “Adventure Pack” or “Extreme Sports” add-on for an additional premium. This will then extend our medical and personal liability cover to include these specific activities.

- Always Check the PDS: This is where we’ll find the definitive list of what activities are included, what requires an add-on, and what might be completely excluded (e.g., professional sports, unguided mountaineering). For example, some policies might cover canyoning but not abseiling, even if they seem similar. We need to be specific about our plans and check the fine print.

So, if we’re planning to dive the Great Barrier Reef or jump off a bridge, make sure our travel insurance Australia policy is ready for the adventure too!

Conclusion

So here we are, at the end of our deep dive into travel insurance Australia. If there’s one thing we hope you take away, it’s this: travel insurance Australia isn’t some optional extra you can skip to save a few dollars. It’s the safety net that stops a dream holiday from turning into a financial nightmare.

Think about it. A typical hospital stay in Australia costs over $3,000 AUD for tourists. That’s just a typical stay. If something serious happens – a car accident, a bad fall while hiking, a sudden illness – we’re talking tens of thousands, potentially hundreds of thousands of dollars. Without proper cover, we’d be personally responsible for every cent. That’s enough to wipe out savings, cancel future trips, or worse.

But travel insurance Australia protects so much more than just our health. It shields us from the domino effect of cancelled flights, lost luggage arriving three days late, or accidentally damaging someone’s property. It gives us access to 24/7 emergency assistance when we’re stressed, scared, and far from home. It means we can actually enjoy our adventure, rather than constantly worrying about what might go wrong.

We’ve covered a lot of ground together – from understanding what comprehensive policies include (and critically, what they exclude) to navigating the complexities of pre-existing medical conditions and COVID-19 cover. We’ve learned how to make a claim, what factors affect our premium, and why declaring everything honestly is non-negotiable. We’ve even picked up some essential safety tips for staying out of trouble in the first place.

The Australian government doesn’t mess around when it says if you can’t afford travel insurance, you can’t afford to travel. They’ve seen too many tourists stuck with impossible medical bills or unable to get home after an emergency. We don’t want that to be our story.

At GoTravelHunt, we’re passionate about helping you plan unforgettable journeys. And part of that is making sure you’re protected every step of the way. A good travel insurance Australia policy means you can dive the Great Barrier Reef, hike through ancient rainforests, or explore vibrant cities knowing that if something goes wrong, you’ve got backup.

Australia is waiting. The beaches are stunning, the wildlife is unique, the people are friendly, and the adventures are endless. So get your policy sorted, pack your bags, and get ready for the trip of a lifetime.