Why Protecting Your Travel Investment Matters

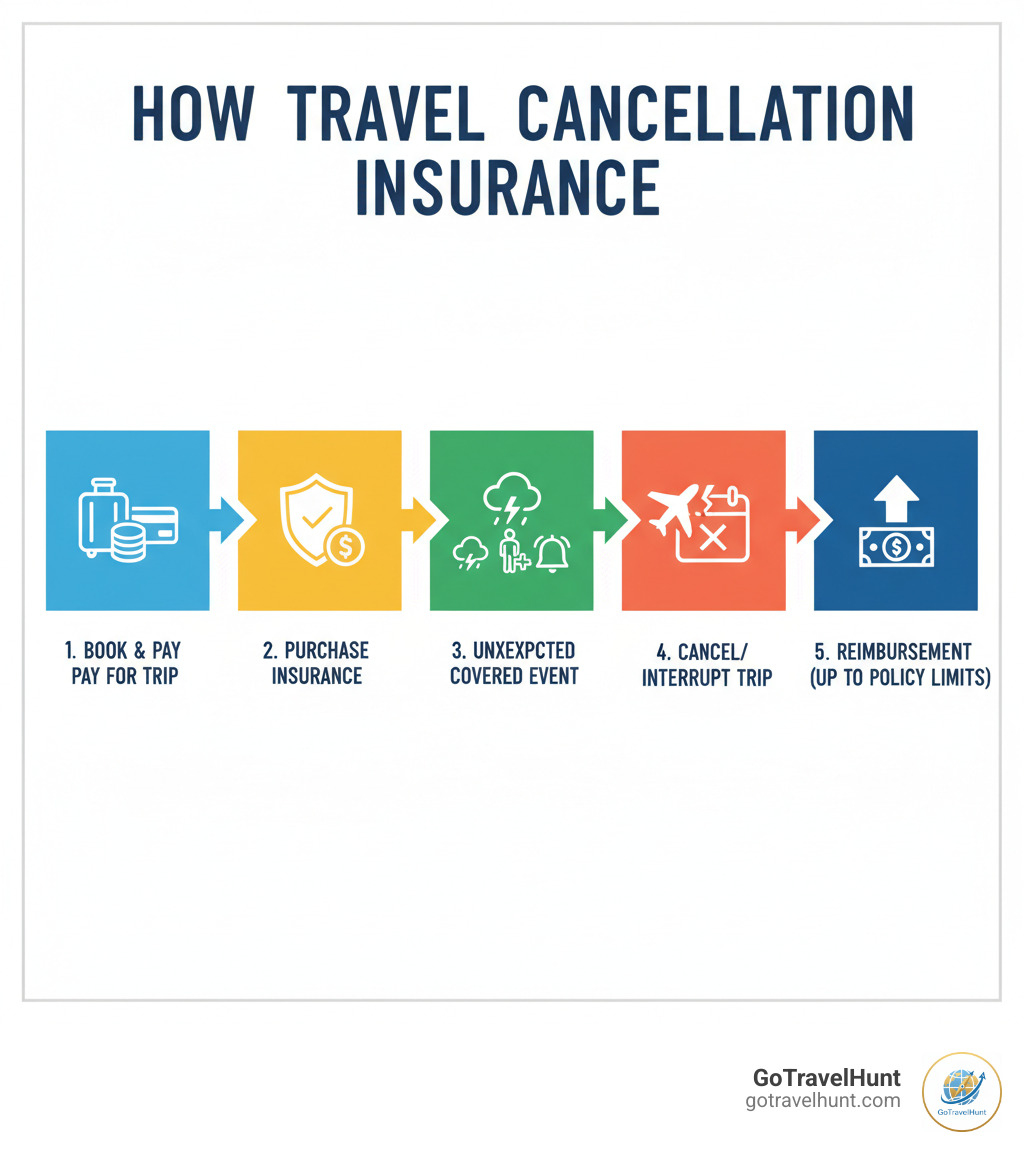

Travel cancellation insurance reimburses you for prepaid, non-refundable travel expenses if you must cancel or interrupt your trip for a covered reason. Here’s a quick overview:

- Trip Cancellation: Reimburses costs if you cancel before your trip due to covered events like illness or family emergencies.

- Trip Interruption: Covers extra costs if you must return home early after your trip has begun.

- Typical Cost: 4-10% of your total trip cost.

- Coverage Limits: Policies often cover up to $5,000-$50,000 per person.

- Common Covered Events: Unexpected illness, family member death, severe weather, job loss, and home disasters.

- Key Exclusions: Pre-existing conditions (without a waiver), foreseeable events, and pandemics (unless specified).

When you’ve invested time and money into planning a trip, an unexpected event like a sudden illness or family emergency can lead to significant financial loss. Without travel cancellation insurance, you could lose thousands in non-refundable deposits for flights, hotels, and tours.

Many travelers mistakenly believe their credit card offers enough protection or that travel providers will offer full refunds. In reality, credit card benefits have strict limits, and full refunds are rare. Dedicated travel cancellation insurance fills this critical gap, protecting investments of up to $40,000 or more.

This insurance is more affordable than many think, typically costing 5-7% of your trip’s total price. As travel experts at GoTravelHunt, we’ve seen how the right coverage provides essential peace of mind and financial security, making it a key part of smart travel preparation.

Essential travel cancellation insurance terms:

- business travel booking software

- online booking tools for business travel

- travel booking tools

Understanding the Basics: Cancellation vs. Interruption

When buying travel cancellation insurance, you’ll see two key terms: trip cancellation and trip interruption. One covers you before you leave, and the other protects you once your trip has started. Understanding the difference is crucial for ensuring you have the right financial protection.

What is Trip Cancellation Insurance?

Trip cancellation insurance is your safety net before departure. If a covered reason forces you to cancel your trip before it begins, this coverage reimburses you for non-refundable prepaid expenses like flights, hotels, and tour packages.

For example, if you book a trip to Italy and fall seriously ill two weeks before departure, you’d normally lose thousands in deposits. With trip cancellation insurance, you can file a claim to get reimbursed for those covered costs.

Coverage applies only for “covered reasons” specified in your policy, such as an unexpected illness, death of a family member, or involuntary job loss. You can’t simply change your mind.

What is Trip Interruption Insurance?

Trip interruption insurance protects you after your trip has started. If a family emergency requires you to return home early or a hurricane forces an evacuation, this coverage becomes your lifeline.

It covers the extra costs of cutting your trip short, such as a last-minute flight home, and reimburses you for the unused portions of your prepaid travel arrangements. It can also cover additional accommodation costs if you’re forced to extend your stay due to a covered event, like a medical emergency that prevents you from flying.

Comparing Trip Cancellation and Trip Interruption

Here’s how these two types of coverage differ:

| Feature | Trip Cancellation Insurance | Trip Interruption Insurance |

|---|---|---|

| Coverage Trigger | Before your trip starts | After your trip has begun |

| Reimbursed Costs | Non-refundable prepaid expenses (flights, hotels, tours, deposits) | Extra transportation costs to return home, additional accommodation expenses, unused portions of prepaid travel |

| Example Scenarios | Sudden illness before departure, family member death, involuntary job loss, jury duty, home disaster | Family emergency requiring early return, medical emergency during trip, severe weather forcing evacuation, missed connections due to covered delays |

Most comprehensive travel cancellation insurance policies bundle both types of coverage. This combined approach provides seamless financial protection, giving you peace of mind whether a problem arises before you leave or while you’re away.

What Does Travel Cancellation Insurance Actually Cover?

Understanding what your travel cancellation insurance covers—and what it doesn’t—is crucial. While reading policy documents isn’t fun, a few minutes of review can save you thousands. Let’s break down the essentials.

Common Covered Events

Most quality plans cover a similar set of unexpected events. These are the moments when your insurance becomes a financial lifeline.

- Unexpected illness or injury: If you, a travel companion, or an immediate family member gets seriously sick or injured before or during your trip.

- Death of a family member: Covers cancellation if a close relative passes away.

- Involuntary job loss: If you are unexpectedly terminated from your job after buying the policy.

- Severe weather and natural disasters: If a hurricane makes your resort uninhabitable or your home is damaged by fire or flood before you leave.

- Travel supplier default: Protects you if your airline, cruise line, or tour operator goes out of business.

- Other events: Often includes lost/stolen travel documents, jury duty, military deployment, and sometimes even quarantine requirements or terrorism at your destination.

The German financial regulatory authority offers helpful consumer information about travel cancellation insurance that explains general conditions.

Common Exclusions and Limitations

Pay close attention to what your policy won’t cover to avoid surprises.

- Pre-existing medical conditions: This is a top reason for claim denials. A condition treated or existing within a “look-back period” (e.g., 60-180 days) before you buy the policy may be excluded. Many policies offer waivers if you buy coverage soon after booking.

- Foreseeable events: Canceling due to a hurricane that was already forecast when you booked is a foreseeable event and likely not covered.

- High-risk activities: Bungee jumping or skydiving usually require special adventure sports coverage.

- Self-inflicted harm or criminal acts: These are universally excluded.

- Change of mind: Not covered unless you purchase a “Cancel For Any Reason” add-on.

- Other exclusions: Often include childbirth during the trip, pregnancy complications, and labor strikes that were known before booking.

Always read your policy document to understand its specific limitations.

Filing a Claim: What You’ll Need

If you need to file a claim, being organized is key. Insurance companies require proof that a covered event occurred and caused a financial loss.

Start by contacting your insurer immediately and gathering the necessary documentation:

- Completed claim form from your insurer.

- Proof of loss: Original booking confirmations, invoices, and proof of payment for all non-refundable expenses.

- Proof of cancellation: Confirmation from your travel providers showing any refunds received (or not received).

- Documentation of the covered event: This could be a doctor’s note for illness, a termination letter for job loss, an official weather report, or a police report for stolen documents.

- Personal identification: A copy of your passport or ID.

Keep digital and physical copies of everything. The more organized your submission, the smoother the claims process will be. If you encounter issues, resources like this guide on the complaint process can help.

Purchasing and Costs: Getting the Right Policy

Choosing the right travel cancellation insurance is as important as buying it. Just as you use Travel Booking Tools to find the best deals, comparing insurance quotes is smart planning.

When to Buy Travel Cancellation Insurance

When you buy your policy matters. The ideal time is right after making your first trip payment—typically within 10 to 21 days. This timing is crucial because it open ups time-sensitive benefits.

One key benefit is the pre-existing medical condition waiver. Most insurers only offer this if you buy coverage within that initial window. Without it, any cancellation related to a pre-existing condition won’t be covered.

Another is the “Cancel For Any Reason” (CFAR) add-on, which often must be purchased within 7 to 21 days of your first payment.

You can still buy insurance up until the day before departure, but you’ll miss out on these benefits. Also, any event that is already known (like a forming hurricane) will be considered a “foreseeable event” and won’t be covered. You cannot buy coverage after you’ve left home.

How Much Does It Cost?

Travel cancellation insurance typically costs between 4% and 10% of your total non-refundable trip cost. For a $5,000 trip, that’s about $200 to $500. It’s a small investment to protect a much larger one.

Premiums are based on:

- Total trip cost: More expensive trips cost more to insure.

- Traveler’s age and number of travelers: Older travelers and larger groups typically pay more.

- Trip length and destination: Longer trips or destinations with high medical costs can increase the premium.

- Coverage level: Higher limits and add-ons will increase the cost.

When comparing quotes, focus on value, not just the lowest price. A cheap policy with major exclusions isn’t a good deal.

The ‘Cancel For Any Reason’ (CFAR) Add-On

The “Cancel For Any Reason” (CFAR) add-on offers the most flexibility. It lets you cancel for any reason not listed in your standard policy, like a personal falling out or simply changing your mind.

However, CFAR has important rules:

- Partial Reimbursement: It typically reimburses only 50% to 75% of your non-refundable costs.

- Higher Cost: It can add 40% to 60% to your base premium.

- Strict Deadlines: You must buy it within 7 to 21 days of your initial trip deposit, insure your full trip cost, and cancel at least 48 hours before departure.

CFAR is ideal for those booking expensive trips far in advance or who want maximum flexibility, but be sure you understand the rules and purchase it within the required timeframe.

Comparing Your Options: Standalone vs. Other Coverage

You have several options for protecting your trip, from standalone policies to credit card benefits. Understanding what each provides—and what gaps they leave—is key. Just as you’d research the Best Things to Pack for International Travel, choosing the right insurance deserves careful attention.

Is Credit Card Travel Insurance Enough?

Many travelers assume their credit card’s travel insurance is sufficient, but it’s rarely a complete solution. These benefits can be a good supplement but shouldn’t be your only line of defense.

- Limited Coverage: Coverage levels vary dramatically. A dedicated travel cancellation insurance policy might cover up to $50,000, while many credit cards cap coverage at a few thousand dollars.

- Strict Requirements: Coverage often only applies if you charge the entire trip to that card, and sometimes only through their travel portal.

- More Exclusions: Credit card policies often have more restrictions, especially for pre-existing medical conditions, and rarely offer add-ons like “Cancel For Any Reason.”

Always read your cardholder agreement or call your provider to understand the specific limitations. A standalone policy usually offers more comprehensive protection.

Trip Cancellation vs. Travel Medical Insurance

This is a common point of confusion. These two insurance types cover entirely different risks, and you often need both.

-

Trip Cancellation Insurance protects your wallet. It reimburses your non-refundable trip costs (flights, hotels, tours) if you have to cancel or interrupt your trip for a covered reason.

-

Travel Medical Insurance protects your health. It covers emergency medical expenses while you’re traveling, such as hospital bills, doctor visits, and emergency medical evacuation. These costs can be astronomical, which is why plans can offer millions in coverage.

Your home health plan likely offers little to no coverage abroad, making travel medical insurance essential. Many companies offer comprehensive packages that bundle both trip cancellation and interruption coverage with emergency medical protection. This all-in-one approach ensures you’re protected financially and medically, offering the best peace of mind.

Frequently Asked Questions about Trip Cancellation Insurance

Here are answers to some of the most common questions we hear about travel cancellation insurance.

What about cancellations due to pandemics like COVID-19?

The COVID-19 pandemic changed the insurance landscape. Before 2020, pandemics were usually excluded. Now, many modern policies offer more protection, but you must read the details.

Look for an ‘Epidemic Coverage Endorsement’ or a specific pandemic add-on. This may cover you if you fall ill with the disease, are forced to quarantine, or if a government advisory prohibits travel to your destination. However, if a travel advisory is already in place when you buy the policy, it’s considered a “foreseeable event” and won’t be covered. Always confirm pandemic coverage specifics with your provider before buying.

Can I get a policy with coverage for pre-existing medical conditions?

Yes, but you must follow specific rules to get a “pre-existing medical condition waiver.” Insurers define a condition as pre-existing if it was treated or showed symptoms during a “look-back period” (usually 60-180 days) before you bought the policy.

To get the waiver, you typically must:

- Purchase your policy within 10-21 days of your initial trip deposit.

- Insure the full non-refundable cost of your trip.

- Be medically stable and able to travel when you buy the policy.

Meeting these criteria is essential to ensure your condition is covered. If you have a pre-existing condition, it’s wise to speak with an agent to confirm you qualify for the waiver.

Can I buy insurance after I’ve already booked my trip?

Yes, you can buy travel cancellation insurance up until the day before you leave. However, waiting has significant drawbacks.

- You cannot buy it after you’ve departed.

- You will likely lose access to time-sensitive benefits like the pre-existing condition waiver and the “Cancel For Any Reason” add-on.

- Any event that is already known (like a named storm) will be excluded from coverage.

For these reasons, we always recommend buying your policy as soon as you make your first non-refundable trip payment. This ensures you get the most comprehensive coverage available.

Conclusion

Planning a dream trip takes time and money. While we hope for the best, unexpected events can derail even the most careful plans. Travel cancellation insurance provides a vital financial safety net and invaluable peace of mind.

As we’ve covered, this insurance protects your investment by reimbursing non-refundable costs if you must cancel or interrupt your trip for a covered reason. Understanding the difference between cancellation and interruption, what’s covered (and what’s not), and the importance of buying your policy early are all key to making an informed decision.

For a cost of just 4-10% of your trip’s price, you can safeguard thousands of dollars. While credit card benefits can be helpful, a dedicated policy typically offers far more comprehensive protection. Combining travel cancellation insurance with travel medical insurance creates a complete safety net for your health and finances abroad.

Smart travel planning means preparing for the unexpected. At GoTravelHunt, we believe protecting your investment is as crucial as planning your itinerary. With the right coverage, you can focus on creating unforgettable memories, worry-free.

Ready to explore with confidence? Find more resources in our Travel Planning Guides at GoTravelHunt. Your next adventure awaits—and now you know how to protect it.