Flight Cancellation Insurance 2025: Ultimate Protection

Why Your Travel Investment Needs Protection

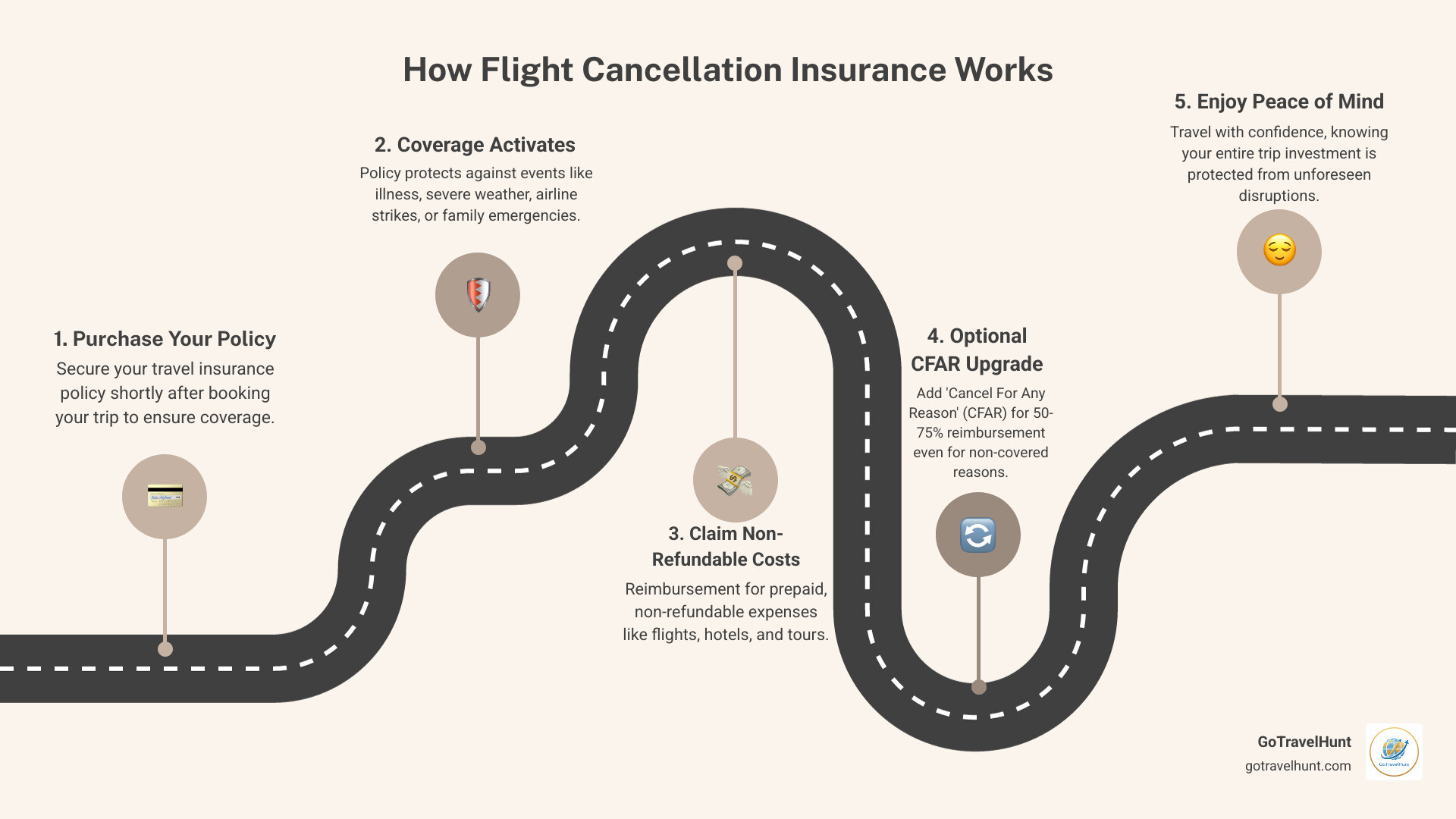

Flight cancellation insurance protects your prepaid travel costs when unexpected events force you to cancel or interrupt your trip. Here’s what you need to know:

Quick Answer: What Flight Cancellation Insurance Covers

- Trip Cancellation: Reimburses non-refundable costs if you cancel before departure for covered reasons (illness, weather, strikes)

- Trip Interruption: Covers costs to return home or continue your trip if cancelled after departure

- Cancel for Any Reason (CFAR): Optional add-on providing 50-75% reimbursement for any reason

- Typical Coverage: Up to 100% of prepaid, non-refundable expenses for covered events

- Purchase Window: Buy within 14-21 days of booking for maximum benefits

Imagine this: You’ve booked your dream vacation months in advance. Flights, hotels, and tours are all paid for and non-refundable. Then, the morning of departure, you receive an email—your flight is cancelled due to severe weather, and the airline can only rebook you 24 hours later. Suddenly, your carefully planned itinerary crumbles.

This scenario plays out thousands of times daily. One insurance claim is made every minute in the UK alone. While airlines typically refund or credit cancelled flights, they won’t reimburse you for the hotel nights you’ll miss, the tours you’ve prepaid, or the connecting flights that no longer work.

That’s where flight cancellation insurance becomes essential. It’s not actually a standalone product—it’s a combination of benefits within a broader travel insurance plan that protects your entire trip investment. Whether the airline cancels your flight due to mechanical issues, you need to cancel because of a family emergency, or your trip gets interrupted mid-journey, the right coverage can save you hundreds or thousands of dollars.

The peace of mind is worth it, especially when you consider that two in five travelers don’t have adequate coverage. With airline disruptions on the rise and trip costs climbing higher, protecting your prepaid plans isn’t just smart—it’s essential.

I’m Ramy Saber, founder of GoTravelHunt and an experienced project manager who has steerd countless travel disruptions. Through researching and writing about flight cancellation insurance, I’ve helped travelers understand how to protect their investments and travel with confidence.

Basic flight cancellation insurance glossary:

- travel insurance flight delay

- best holiday insurance

- compare holiday insurance

What is Flight Cancellation Insurance and How Does It Work?

Think of flight cancellation insurance as your financial safety net for when travel plans fall apart. Here’s the thing though—it’s not actually something you buy on its own. Instead, it’s a key benefit tucked inside a comprehensive travel insurance policy, working alongside other protections to shield your entire trip investment.

When we talk about flight cancellation insurance, we’re really talking about two main benefits: Trip Cancellation (which covers you if you can’t depart) and Trip Interruption (which steps in if your trip gets cut short after you’ve already left). Both are designed to reimburse you for prepaid, non-refundable expenses when unexpected events derail your plans.

So what actually triggers coverage? Your policy will list specific “covered reasons” that qualify for reimbursement. These typically include severe weather that grounds flights, mechanical issues with the aircraft that cause significant delays, airline employee strikes, or even major global events that make travel impossible. The key word here is “unexpected”—these need to be circumstances you couldn’t have reasonably predicted when you booked your trip.

Here’s an important clarification: According to the Department of Transportation, if an airline cancels your flight, you’re entitled to a refund regardless of whether you bought a “non-refundable” ticket. That’s good news, but it only covers the flight itself. Your insurance picks up where the airline’s responsibility ends—covering all those other prepaid costs that would otherwise be lost.

When the Airline Cancels Your Flight

Let’s say you wake up to a notification that your flight has been cancelled. Your first move should always be contacting the airline directly. They’re legally obligated to offer you rebooking options or a refund—even on non-refundable tickets. Sometimes they’ll provide hotel vouchers if you’re stranded overnight, but their responsibility essentially ends with getting you to your destination eventually.

But what happens to everything else you’ve paid for? That’s where flight cancellation insurance becomes your best friend. Your hotel in Rome that you can’t check into on time? The skip-the-line Vatican tour you’ll miss? The train tickets to Florence that are now useless? Those costs can add up to hundreds or even thousands of dollars.

If the airline’s cancellation causes a significant delay—typically 24 consecutive hours or more from your original arrival time—and it’s due to a covered reason like severe weather or mechanical failure, your insurance can reimburse you for these non-flight expenses. You’ll need to document everything (save those confirmation emails and receipts), but you can recover costs that would otherwise be completely lost.

This protection becomes especially valuable when you’ve built a complex itinerary. Missing that first connection can create a domino effect that ruins carefully timed bookings throughout your trip. While you’re exploring options for Cheap Flight Deals, protecting those savings with insurance makes financial sense.

When You Need to Cancel Your Flight

Sometimes the cancellation decision is yours, not the airline’s. Life happens—and it doesn’t care about your vacation dates. This is where understanding your policy’s “covered reasons” becomes critical.

Standard flight cancellation insurance typically covers you when unexpected personal emergencies force you to cancel. We’re talking about situations like a sudden serious illness (either yours, your traveling companion’s, or a close family member’s), an unexpected death in the family, or a serious accident. These events need to be unforeseen and significant enough that traveling would be unreasonable or impossible.

Other commonly covered scenarios include pregnancy complications that develop after you’ve booked, involuntary job loss from permanent employment, jury duty you couldn’t get out of, or a natural disaster that makes your home uninhabitable right before departure. Some policies also cover unexpected adverse reactions to required vaccinations.

Here’s the catch: your reason for canceling must be explicitly listed in your policy. If you simply change your mind about traveling, feel nervous about flying, or decide you can’t afford the trip anymore, standard policies won’t reimburse you. These are considered voluntary cancellations without a covered reason.

When you do need to cancel for a covered reason, your insurance reimburses the prepaid, non-refundable costs of your airline tickets along with your other prepaid trip expenses. You’ll need to provide documentation—medical certificates for illness, death certificates for bereavement, official notices for jury duty—but the reimbursement can save you from losing your entire trip investment.

The peace of mind alone is worth considering. Nobody plans to get sick or face a family emergency, but knowing you’re protected if the worst happens lets you book those non-refundable deals with confidence.

Key Coverage Types and Limits Explained

Understanding the different facets of flight cancellation insurance can feel like deciphering a complex puzzle. However, by breaking down the key coverage types and their limitations, we can clarify how your travel investment is protected.

Think of flight cancellation insurance as an umbrella term that covers several related protections. Most comprehensive travel insurance plans bundle these benefits together, each designed to protect you at different stages of your journey. The key is knowing which type of coverage kicks in when, and what limits apply.

Trip Cancellation vs. Trip Interruption Insurance

These are the two primary benefits within most travel insurance plans that address flight cancellations, and while they work in tandem, they cover different phases of your journey.

Trip Cancellation Insurance is your safety net before you leave home. If something unexpected happens and you need to cancel your entire trip before departure, this coverage reimburses you for your prepaid, non-refundable expenses. This includes your flight tickets, hotel reservations, tour bookings, and other costs you’ve already paid but can’t get back.

Trip Interruption Insurance, on the other hand, protects you after your trip has already started. If your flight gets cancelled mid-journey or you need to cut your trip short due to a covered reason, this benefit covers the additional costs to either return home early or continue your trip. It also reimburses you for the unused portion of your prepaid expenses.

Here’s a practical example: You’re on a two-week European tour, and on day five, you receive news of a family emergency requiring you to return home immediately. Your return flight gets cancelled due to mechanical issues, forcing you to book a more expensive last-minute alternative. Trip Interruption coverage would reimburse you for both that expensive replacement flight and the remaining nine days of prepaid hotels and tours you’ll miss.

The main difference comes down to timing. Trip Cancellation protects your investment before you depart, while Trip Interruption protects you once you’re already traveling. Both typically reimburse you for covered reasons like serious illness, family emergencies, severe weather, or unexpected events that prevent travel.

The Ultimate Flexibility: ‘Cancel for Any Reason’ (CFAR)

Standard flight cancellation insurance only covers specific, predefined reasons for cancellation. But what if your reason doesn’t fit neatly into those categories? That’s where Cancel for Any Reason coverage becomes invaluable.

CFAR is an optional upgrade that gives you significantly more flexibility. As the name suggests, it allows you to cancel your trip for literally any reason—even if you simply change your mind—and still receive partial reimbursement. Changed your mind about the destination? Feeling anxious about traveling? With CFAR, you’re covered.

However, this flexibility comes with some important conditions. First, CFAR typically reimburses you for only 50-75% of your non-refundable costs, not the full 100% that standard coverage provides for approved reasons. Second, you usually need to purchase CFAR within a specific window—typically 14 to 21 days after making your initial trip deposit. Third, you must cancel your trip at least 48 to 72 hours before your scheduled departure to qualify for reimbursement.

Despite these limitations, CFAR can be worth the extra cost for high-value trips, complex itineraries, or if you’re booking far in advance and worried about circumstances changing. For more details on how cancellation coverage works, check out our guide on Travel Cancellation Insurance.

Understanding Coverage Limits and Common Exclusions

Even with comprehensive flight cancellation insurance, it’s crucial to understand that coverage isn’t unlimited and doesn’t apply to every situation.

Most policies will reimburse you up to 100% of your prepaid, non-refundable costs for covered reasons, but there’s typically a maximum dollar limit stated in your policy. This limit varies by plan—some might cap out at $10,000, while others go up to $100,000 or more. Make sure your policy limit matches or exceeds your total trip cost.

Equally important are the exclusions—situations where your insurance won’t cover you. Pre-existing medical conditions are a common exclusion, though many insurers offer waivers if you purchase your policy soon after booking. Foreseeable events are another major exclusion. If you book a trip to an area already under a hurricane warning or travel advisory, you likely won’t be covered if that known risk disrupts your plans.

Other typical exclusions include cancellations due to deliberate acts on your part, changes in employment that you knew about when booking, or financial circumstances like not being able to afford the trip. According to BaFin, Germany’s financial regulatory authority, understanding these exclusions before purchasing is essential for European travelers.

The bottom line? Read your policy documents carefully. Know what’s covered, what’s excluded, and what your maximum reimbursement limits are. This knowledge ensures you’re not caught off guard when you need to file a claim.