Trip Medical Insurance: Your Essential 2025 Safety

Why Trip Medical Insurance is Essential for Every Traveler

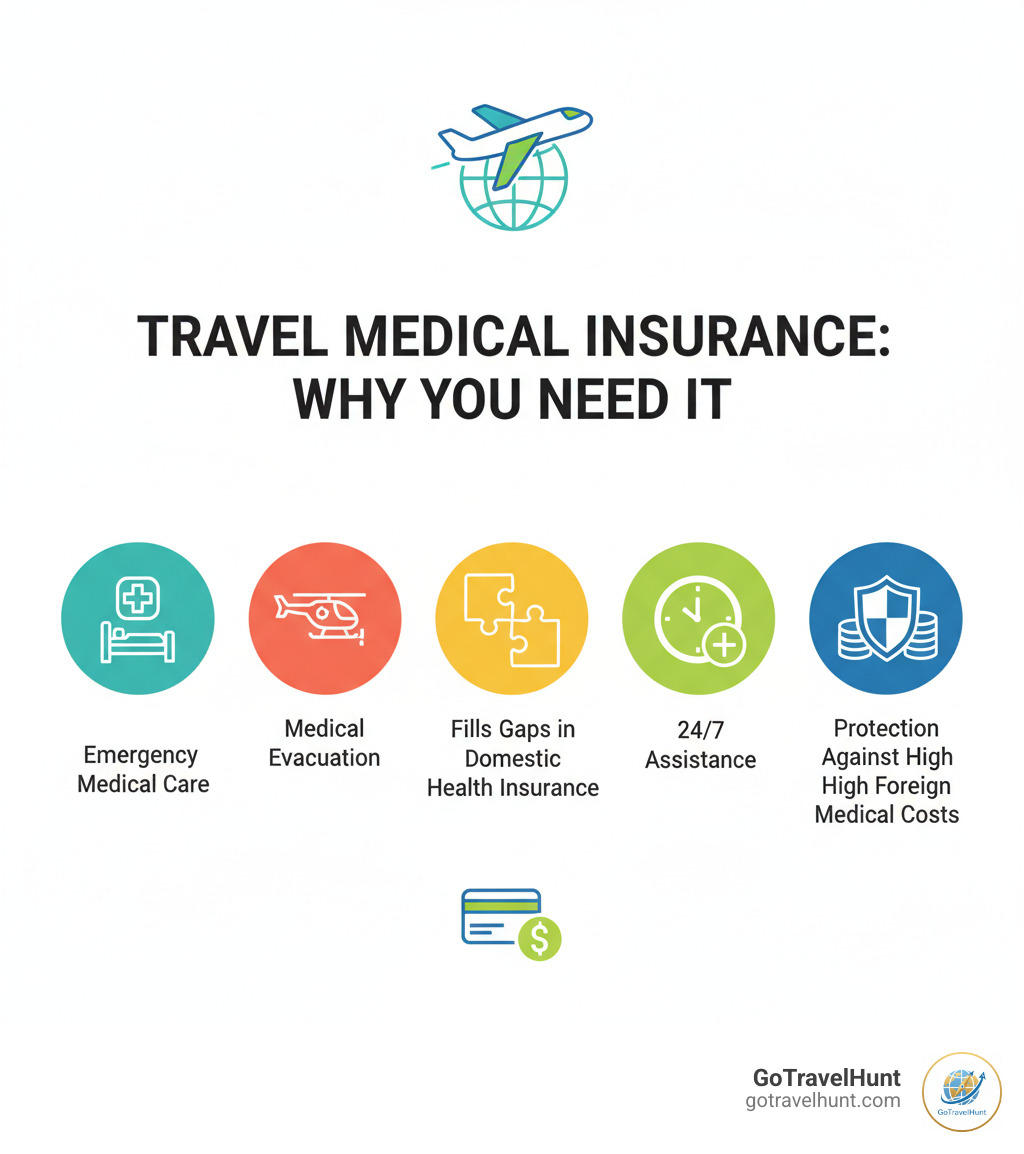

Trip medical insurance is a specialized policy designed to cover emergency medical expenses when you travel outside your home country. It acts as your financial and logistical safety net, ensuring a health crisis abroad doesn’t turn into a financial catastrophe. Here’s what you need to know:

Key Benefits:

- Emergency medical care – This is the core of any policy. It covers unexpected illnesses and injuries, including costs for hospital stays, doctor visits, surgery, anesthesia, diagnostic tests like X-rays or MRIs, and urgent treatments.

- Medical evacuation – If you suffer a serious injury in a remote location or a place with inadequate medical facilities, this benefit covers the cost of transporting you to the nearest hospital that can provide appropriate care. These costs can easily exceed $100,000, making this a crucial component of your coverage.

- 24/7 assistance – This invaluable service connects you with a multilingual team that can help you steer a crisis. They can help you find vetted doctors and hospitals, guarantee payment to foreign facilities, arrange for translation services, and keep your family back home informed.

- Fills coverage gaps – Most U.S. health plans, including employer-sponsored ones, offer little to no coverage outside the country. Trip medical insurance is specifically designed to fill these critical gaps.

- Financial protection – Without insurance, you are personally liable for all medical costs. A policy prevents a medical emergency from leading to massive out-of-pocket bills and potentially years of debt.

Critical Facts:

- The U.S. government explicitly states it does not pay medical costs for its citizens abroad.

- Medicare and Medicaid offer zero coverage outside the United States. You are completely on your own.

- Foreign hospitals and clinics often operate on a “payment-first” basis and may require immediate cash payment or proof of insurance before providing treatment.

- The average policy costs just $75-$125 for a typical trip, a tiny fraction of the potential cost of a single medical incident.

Most travelers don’t realize their domestic health insurance stops working the moment they cross an international border. Without trip medical insurance, a simple illness like a severe stomach bug or an injury from a fall can lead to tens of thousands of dollars in bills.

The cost of medical care varies wildly across the globe. A hospital stay that might cost $5,000 in the U.S. could be $50,000 in Japan or Switzerland. Even in countries with lower overall costs, an emergency evacuation by air ambulance can easily exceed $100,000 if you’re in a remote area.

I’m Ramy Saber, founder of GoTravelHunt, and through years of managing international projects and traveling extensively, I’ve seen why trip medical insurance is non-negotiable for any international journey. This guide will walk you through everything you need to know about choosing, purchasing, and using trip medical insurance effectively.

Who Needs Trip Medical Insurance?

Simply put, anyone traveling outside their home country’s healthcare network needs this coverage. This includes:

- International Vacationers: Whether you’re on a two-week holiday or a weekend getaway, accidents can happen anywhere.

- Business Travelers: Work trips are not immune to health emergencies.

- Students Studying Abroad: Most universities and visa programs require students to have adequate health coverage for their stay.

- Digital Nomads and Long-Term Travelers: The longer you’re abroad, the higher the chances you’ll need to see a doctor.

- Adventure Travelers: If your plans include hiking, skiing, or diving, your risk of injury is higher, making medical and evacuation coverage even more critical.

Common trip medical insurance vocab:

Understanding Your Trip Medical Insurance Coverage

Picture this: you’re hiking through the stunning mountains of Peru when you suddenly feel sharp chest pains. Or maybe you’re enjoying fresh seafood in Thailand and develop a severe allergic reaction. It could even be something as common as a bout of food poisoning in Mexico that leaves you severely dehydrated and in need of medical attention. These are exactly the moments when trip medical insurance becomes your safety net.

Trip medical insurance covers the unexpected health emergencies that can happen when you’re far from home. The coverage is specifically for sudden and acute illnesses or injuries. It typically includes:

- Emergency medical care: This covers your bills for hospital rooms, intensive care units, physician services, and other necessary treatments to stabilize your condition.

- Emergency dental treatment: If you break a tooth or develop a painful abscess, this benefit covers the cost to alleviate the immediate pain, not for routine dental work.

- Ambulance services: This includes ground and sometimes air ambulance transport to get you to the nearest appropriate facility that can treat your condition.

- Prescription drugs: Covers medications prescribed by a doctor to treat the covered emergency during your trip.

- 24/7 assistance services: This is your lifeline. When you’re sick or injured in a foreign country where you don’t speak the language, having someone available around the clock to find local doctors, coordinate care, and even arrange payment guarantees to the hospital can make all the difference. They act as your advocate when you are at your most vulnerable.

What is trip medical insurance and why is it essential?

Here’s something that surprises many travelers: trip medical insurance often works as secondary coverage. This means it is designed to fill the gaps left by your regular, or “primary,” health insurance. Most of us assume our domestic health plan will protect us wherever we go, but that’s rarely true for international travel.

The reality is stark. The U.S. government does not pay medical costs for citizens traveling abroad. Furthermore, Medicare and Medicaid offer zero coverage outside the United States. Even if your private health insurance provides some international coverage, it’s often limited to “out-of-network” rates, which come with high deductibles and co-pays. Worse, most foreign hospitals don’t have billing agreements with U.S. insurers, meaning you’ll be required to pay the full amount upfront and then fight for reimbursement later—a daunting task when you’re dealing with a medical emergency.

The high cost of foreign medical care makes this coverage essential. A simple broken arm could cost $2,500 in Mexico or over $15,000 in the U.S. A more serious illness requiring a multi-day hospitalization? That could easily reach $50,000 or more, especially in developed nations. Many foreign hospitals will not admit you, even in an emergency, without a cash deposit or proof of insurance that can guarantee payment. For more detailed information about international health coverage, review the CDC insurance page, which emphasizes that some policies can even make direct payments to hospitals on your behalf.

Without trip medical insurance, you’re essentially gambling with your financial future every time you travel internationally. A single medical emergency could wipe out your savings and leave you with debt that takes years to repay.

Travel Medical vs. Comprehensive Travel Insurance

Not all travel insurance is created equal, and understanding the difference can save you money and ensure you get the right protection for your needs.

Travel Medical Insurance focuses specifically on health and safety emergencies. Its primary purpose is to cover emergency medical and dental care and medical evacuation if you need to be transported to an adequate facility. Think of it as your healthcare safety net abroad—nothing more, nothing less. It’s lean, focused, and highly affordable.

Comprehensive Travel Insurance, on the other hand, is an all-in-one package that bundles medical coverage with a suite of trip protection benefits. Beyond the medical benefits, it also covers financial losses related to your travel arrangements, such as trip cancellation if you can’t go, trip interruption if you need to cut your journey short, baggage loss if your luggage goes missing, and travel delays when flights get canceled or postponed.

| Feature | Travel Medical Insurance | Comprehensive Travel Insurance |

|---|---|---|

| Primary Focus | Emergency medical and dental care | Medical benefits plus trip protection |

| Medical Coverage | Yes – emergency care only | Yes – emergency care included |

| Medical Evacuation | Yes | Yes |

| Trip Cancellation | No | Yes |

| Trip Interruption | No | Yes |

| Baggage Loss | No | Yes |

| Travel Delays | No | Yes |

| Best For | Healthy travelers on a budget, or those with flexible/refundable trip plans, mainly concerned about medical emergencies. | Travelers with significant non-refundable trip costs who want complete protection for their entire travel investment. |

How to Choose Between Them

Your choice depends on your priorities and the nature of your trip. Ask yourself these questions:

- What is your main concern? If you’re primarily worried about a catastrophic medical event and less about losing the cost of your flight, a travel medical plan is a cost-effective solution.

- How much money is at risk? If you’ve prepaid thousands of dollars for non-refundable tours, flights, and accommodations, the trip cancellation and interruption benefits of a comprehensive plan are invaluable. The premium for a comprehensive plan is typically 5-10% of your total trip cost.

- What is your risk tolerance? Are you okay with the possibility of losing your luggage or paying for a hotel during a long delay? If not, a comprehensive plan offers broader peace of mind.

If your main concern is avoiding catastrophic medical bills abroad, trip medical insurance provides targeted protection at a lower cost. For more details on protecting your trip investment, check out our guide on travel cancellation insurance.