American Express Flight Insurance: Ultimate Safe 2025

Why American Express Flight Insurance Matters for Your Next Journey

American Express flight insurance is a suite of complimentary travel protection benefits included with many Amex credit cards, designed to cover unexpected events that can disrupt your trip. Here’s a quick overview of what it can cover:

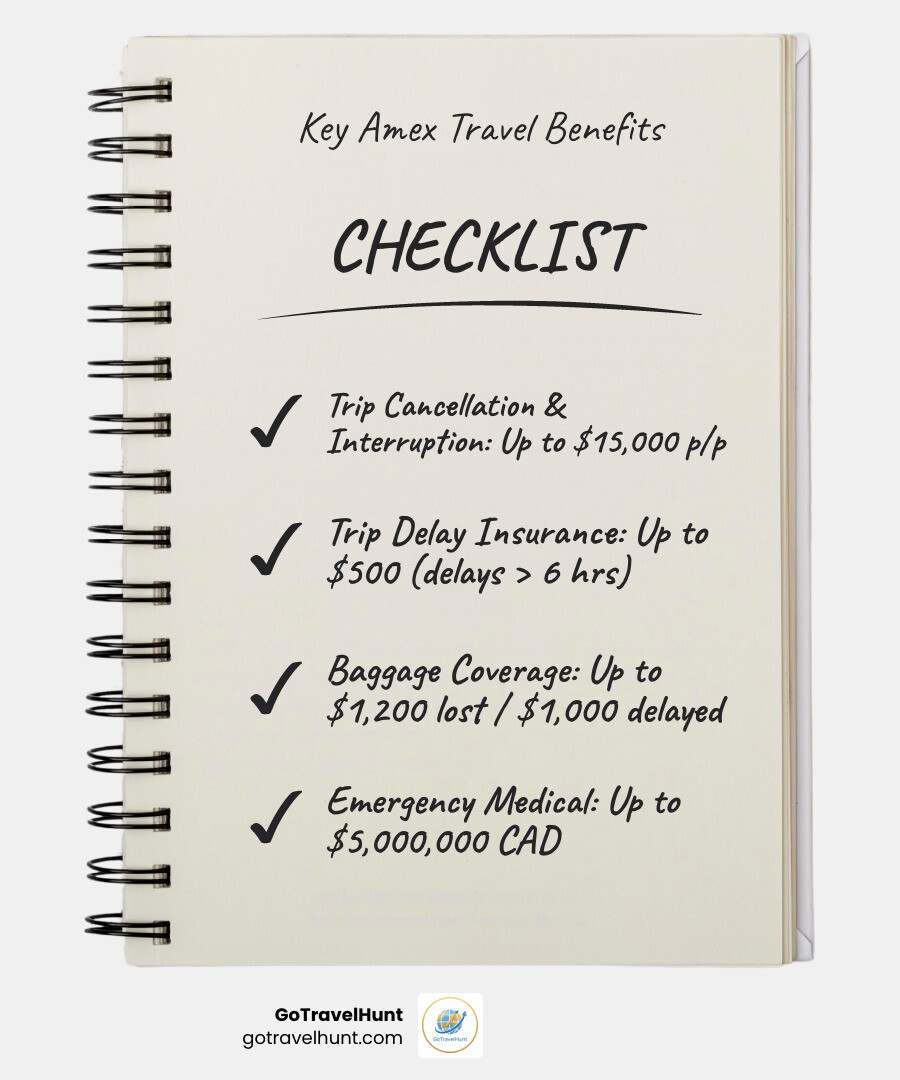

Key American Express Travel Protection Benefits:

- Trip Cancellation & Interruption: Reimburses non-refundable trip costs (up to $15,000 per person) if you must cancel or cut short your trip for a covered reason.

- Trip Delay Insurance: Provides up to $500 per trip for reasonable expenses like meals and lodging when your flight is delayed more than 6 hours.

- Baggage Coverage: Reimburses up to $1,200 for lost checked baggage and up to $1,000 for baggage delayed more than 4 hours.

- Emergency Medical Insurance: Covers medical emergencies while traveling, with benefits up to $5,000,000 CAD on certain cards.

- Travel Accident Insurance: Provides up to $500,000 for accidental death or dismemberment during travel on a common carrier.

These benefits are automatically included with eligible cards when you pay for your trip with the card. However, coverage is typically secondary (meaning it kicks in after other insurance) and is subject to specific terms. Premium cards like The Platinum Card® offer more comprehensive coverage.

I’m Ramy Saber, founder of GoTravelHunt. As an experienced traveler, I’ve learned how to leverage these benefits to travel with greater confidence. This guide will break down what american express flight insurance means for you.

Basic american express flight insurance vocab:

Understanding the Spectrum of Amex Travel Protections

When people discuss american express flight insurance, they’re often referring to a broad suite of complimentary travel protections bundled with many American Express cards. These benefits activate automatically when you use your eligible Amex card to pay for travel, with premium cards typically offering more generous coverage than basic ones.

Trip Cancellation and Trip Interruption Insurance

If an unexpected event forces you to cancel or cut a trip short, this coverage can be a lifesaver.

Trip Cancellation protects your investment before your trip begins. If a covered reason forces you to cancel, it can reimburse non-refundable, pre-paid costs like flights and hotels.

Trip Interruption applies after your trip has started. If you must return home early for a covered reason, it reimburses the unused, non-refundable portion of your trip and can cover emergency travel costs.

“Covered reasons” typically include sickness, injury, death of a traveler or immediate family member, severe weather, terrorist acts, or jury duty. Many eligible cards offer coverage up to $15,000 per person and $30,000 per family per trip. For more details, see our guide on travel cancellation insurance.

Trip Delay and Baggage Insurance

American express flight insurance benefits often cover common travel headaches like delays and lost luggage.

Trip Delay Insurance activates when your trip is delayed by more than six hours for covered reasons like weather or equipment failure. It reimburses reasonable expenses such as meals, lodging, and toiletries, typically up to $500 per covered trip.

Baggage Insurance addresses luggage issues. If your bag is delayed for more than four hours, you can be reimbursed up to $1,000 for essential purchases. If your checked baggage is lost or stolen, you could receive up to $1,200 per trip to replace your belongings. Always keep receipts for any emergency purchases.

Emergency Medical and Travel Accident Insurance

Being prepared for medical emergencies is crucial, especially when traveling abroad.

Emergency Medical Insurance is vital for international travel, as your home health plan may offer limited coverage. Amex’s benefits can cover hospital, surgical, and medical treatments for emergencies. Some Canadian cards provide up to $5,000,000 CAD per person, per trip. This may include emergency medical transportation, dental treatment, and prescription expenses. The Platinum Card holders also get access to Platinum Travel Assistance for medical referrals and coordination. You can also find the best holiday insurance to supplement your coverage.

Travel Accident Insurance offers coverage for accidental death or dismemberment while traveling on a common carrier (e.g., plane, train) when the fare was charged to your eligible Amex card. Coverage can be up to $500,000 on premium cards.

Related Travel and Purchase Benefits

Beyond trip-specific coverage, Amex cards often include other valuable protections.

Car Rental Loss and Damage Insurance covers damage or theft of a rental vehicle when you charge the full rental to your card and decline the rental company’s waiver. Coverage can reach up to $85,000 MSRP for up to 48 consecutive days. Luxury vehicles and certain other car types are often excluded.

Purchase Protection may reimburse you if an item bought with your card is accidentally damaged, stolen, or lost within 90 days of purchase (a deductible, often $75, may apply).

Extended Warranty can add up to one additional year to the original manufacturer’s warranty (of five years or less) on eligible items purchased with your card.

Coverage Details: What’s Included and What’s Not

Understanding the specifics of your american express flight insurance is key to using it effectively. It’s important to know the coverage limits and, just as crucial, the exclusions.

A critical point is that most Amex travel benefits provide secondary coverage. This means they apply after any other insurance you have, such as a personal travel policy or coverage from an airline, has paid out. The policies are administered by third-party underwriters like AIG, Royal & Sun Alliance Insurance Company of Canada, and Belair Insurance Company Inc.

Maximum Coverage Amounts for American Express Flight Insurance

Coverage limits vary significantly based on the card. Premium cards with higher annual fees generally offer more generous protection. Here’s a typical breakdown:

| Benefit Type | Maximum Coverage Amount (Typical) | Notes |

|---|---|---|

| Trip Cancellation | Up to $15,000 per person / $30,000 per family | For eligible non-refundable expenses. |

| Trip Interruption | Up to $15,000 per person / $30,000 per family | For eligible non-refundable unused portion & return travel. |

| Trip Delay Reimbursement | Up to $500 per covered trip | For reasonable expenses (meals, lodging) after a 6+ hour delay. |

| Baggage Delay | Up to $1,000 | For essential clothing/toiletries after a 4+ hour delay. |

| Lost Checked Baggage | Up to US$1,200 per trip | Reimbursement if luggage is not recovered. |

| Emergency Medical Services | Up to US$250,000 (or $5,000,000 CAD) | For hospital, medical treatment abroad. |

| Emergency Medical Transportation | Up to US$100,000 | For medically necessary transport. |

| Emergency Dental Treatment | Up to US$1,000 | For emergency dental care. |

| Accidental Death/Dismemberment | Up to US$500,000 (or $50,000) | While traveling on a common carrier (card dependent). |

| Legal Assistance (Advance) | Up to US$10,000 | For legal fees and bail (Platinum Travel Assistance). |

| Car Rental Loss and Damage | Up to $85,000 MSRP | For damage/theft of eligible rental vehicles. |

| Purchase Protection | (Varies, often per incident/year) | Against damage/theft for 90 days (e.g., $75 deductible). |

| Extended Warranty | Up to 1 additional year | Extends original warranty for 5 years or less. |

These figures are a general guide. Always consult your specific card’s Guide to Benefits for exact limits.

Key Exclusions and Limitations to Be Aware Of

Understanding what american express flight insurance doesn’t cover is essential to avoid surprises.

- Pre-existing medical conditions: Conditions that were not stable for a set period (often 90 days) before your trip are typically not covered.

- Risky activities: Extreme sports like skydiving or mountaineering, as well as professional athletics, are usually excluded.

- War or political instability: Travel to destinations under a government “Do Not Travel” advisory may void your coverage.

- Intentional or illegal acts: Self-inflicted injuries, illegal activities, and fraudulent claims are not covered.

- Known issues: Losses from events you were aware of before your trip (e.g., a forecasted hurricane) are not covered.

- Substance abuse: Incidents resulting from alcohol or drug abuse will disqualify a claim.

- Car rental exclusions: Luxury cars, exotic vehicles, trucks, and large vans are often excluded from rental car coverage.

Before you travel, take a few minutes to Read the official Trip Delay Insurance policy and your card’s complete Guide to Benefits. This small step can save you significant trouble later.

Activating Your American Express Flight Insurance: Eligibility and Requirements

While american express flight insurance is a complimentary benefit, it doesn’t activate automatically. You must meet specific criteria to ensure you’re covered. Understanding these requirements before you book is crucial.

Who is Eligible for Coverage?

Coverage often extends beyond the primary cardholder, making it valuable for family and group travel.

- Primary Card Member: You are covered when you use your card for eligible travel purchases.

- Additional Card Members: They typically receive the same benefits when using their authorized card for the purchase.

- Spouses and Dependent Children: They are often covered when their portion of the trip is booked with your eligible Amex card, even without their own card.

- Traveling Companions: Some benefits, like Trip Cancellation, may cover non-family companions if their trip costs are also paid for with your eligible card.

Definitions of “dependent child” or “traveling companion” can vary, so always check your card’s Guide to Benefits to confirm who is included under each coverage type.

Card Requirements and How to Ensure Coverage

Meeting these straightforward requirements is non-negotiable for activating your american express flight insurance.

First, you must hold an eligible American Express card that offers these benefits. Premium cards like The Platinum Card®, Delta SkyMiles® Reserve Credit Card, Hilton Honors American Express Aspire Card, and Marriott Bonvoy Brilliant™ American Express® Card are known for their comprehensive travel protections. Always confirm your specific card is eligible.

The most critical requirement is the full fare payment rule. You must charge the complete cost of your covered trip to your eligible Amex card. Splitting payments between different cards could void your coverage.

For award travel or trips booked with points, you can often still be covered. Many policies consider the “full amount” paid if you use points (like Membership Rewards) and pay the remaining taxes and fees with your Amex card. This is a significant perk for rewards travelers, but you should verify the exact terms for your card.

Finally, your card account must be active and in good standing when the incident occurs and when you file a claim. A delinquent or closed account will prevent you from accessing these benefits.

The Claims Process: A Step-by-Step Guide

If your trip is disrupted, knowing how to file a claim for your american express flight insurance benefits can make a stressful situation more manageable. The process is generally straightforward but requires prompt action and good record-keeping.

How to File a Claim for American Express Flight Insurance

Acting quickly and keeping detailed records is the key to a smooth claims process.

-

Notify the Insurer Immediately: As soon as an incident occurs (delay, lost bag, medical issue), contact the claims administrator. Most policies require notification within 60 days. Early reporting allows the insurer to guide you on the next steps.

-

Gather All Documentation: This is the most critical step. You will need your Amex card statement showing the trip purchase, travel itineraries, and a written statement from the airline or other carrier explaining the issue (e.g., reason for delay). For medical claims, collect all bills and doctor’s notes. For baggage issues, get a copy of the Property Irregularity Report from the airline.

-

Keep All Receipts: Save original receipts for all expenses incurred due to the covered event, such as hotels, meals, or toiletries. Without proof of these costs, you cannot be reimbursed.

-

Submit Your Claim: The fastest way to file is usually through the insurer’s online claims portal. For Trip Delay Insurance, you can call 1-844-933-0648 or visit aig.claimnotify.com/americanexpress. For other Amex Travel Insurance benefits in Canada, the number is 1-844-200-8959. Upload your documents directly to expedite the process. You generally have 180 days to submit your written proof of loss.

-

Track Your Claim: After submitting, you’ll get a claim number. Use this number to track your claim’s status online or by calling customer service.

Understanding the Role of Third-Party Insurers

It’s important to know that American Express does not handle claims directly. They partner with specialized insurance companies who underwrite the policies, process claims, and issue payments.

In the U.S., the underwriter is typically New Hampshire Insurance Company, an AIG company. In Canada, it’s often Royal & Sun Alliance Insurance Company of Canada (RSA) or Belair Insurance Company Inc. You can visit the RSA Group website for more details.

This means when you file a claim, you are dealing with these expert insurers, not Amex. This partnership benefits you by leveraging their established infrastructure and expertise in handling complex travel insurance situations efficiently.

Frequently Asked Questions about Amex Travel Protection

Navigating travel insurance can bring up many questions. Here are answers to common queries about american express flight insurance to help you make informed decisions.

What is the difference between primary and secondary coverage?

This is a critical distinction. Most american express flight insurance benefits are secondary coverage. This means the benefit pays out only after any other insurance you have has been used. For example, if an airline delays your flight, you must first seek compensation from the airline and any personal travel insurance policy you hold. Your Amex benefit would then cover remaining eligible expenses up to its limit.

For car rentals, you would first file a claim with your personal auto insurance. The Amex benefit would then cover the deductible and other remaining qualified costs.

Primary coverage, which is less common for complimentary benefits, pays first without requiring you to file with other insurers. Always assume your Amex benefits are secondary unless the policy explicitly states otherwise.

Are trips booked with points or miles covered?

Yes, trips booked with rewards like Membership Rewards points or airline miles can often be covered by american express flight insurance. The key condition is that the “full fare” must be charged to your eligible Amex card.

Policies often define “full fare” to include trips where you used points, vouchers, or certificates, as long as you paid the remaining taxes and fees with your Amex card. For instance, if you redeem points for a flight and pay the $150 in taxes with your Platinum Card, the trip would typically be eligible for coverage.

Because terms can vary, always check your card’s Guide to Benefits for the exact definition of “full fare” and keep records of your redemption and card payment.

How are pre-existing medical conditions handled?

Pre-existing conditions are a common exclusion in most travel insurance policies, including american express flight insurance.

Coverage for a medical emergency typically applies only if your pre-existing condition was considered stable for a specific period before your trip. This “look-back window” is often 90 days before your departure. “Stable” generally means you have had no new symptoms, diagnoses, or changes in medication or treatment for that condition during the look-back period.

If your condition was not stable, any emergency related to it will likely be excluded from coverage. For example, if your doctor adjusted your blood pressure medication a month before your trip, that condition may be considered unstable.

It is vital to read your Certificate of Insurance carefully. If you have any concerns about a condition’s stability, contact the insurance underwriter (like AIG or RSA) before you travel to clarify your coverage. The importance of reading the Certificate of Insurance cannot be overstated.

Conclusion: Is Amex Flight Insurance Right for Your Trip?

We’ve covered the details of american express flight insurance, from trip cancellation to the claims process. The bottom line is that these complimentary benefits offer valuable financial protection when travel plans go awry.

At GoTravelHunt, we aim to make travel planning stress-free, and that includes understanding the safety nets in your wallet. The protections included with your American Express card are practical tools that can save you significant money when faced with unexpected disruptions.

However, american express flight insurance may not be a complete solution for every trip. The benefits are helpful, especially for shorter domestic trips, but they have limitations. Most are secondary coverage, and there are key exclusions for pre-existing conditions, risky activities, and travel to certain regions.

So, is it right for your trip? For a short getaway with modest costs, the included benefits might be sufficient. For a long international journey, a cruise, or a trip with large non-refundable deposits, consider supplementing your Amex benefits with a dedicated travel insurance policy. This is especially true if you have pre-existing medical conditions. You can explore comprehensive travel insurance options for your next journey to find the right fit.

Our most important advice is to do your homework. Before you book, spend a few minutes reading your card’s Guide to Benefits. Knowing your coverage limits upfront is far better than finding them during an emergency. This knowledge transforms your credit card from a payment tool into a travel protection asset, giving you the peace of mind to enjoy your journey.

Ready to plan your next adventure with confidence? Explore comprehensive travel insurance options for your next journey with GoTravelHunt.