Average cost of travel insurance with cancer #1 Safe

Understanding the Financial Reality of Travel Insurance for Cancer Patients

The average cost of travel insurance with cancer varies widely, but here’s what you can expect:

- Budget range: £200 to £3,500+ for a single trip

- Europe trips: Generally £200-£1,200 for 1-2 weeks

- USA trips: Often significantly higher due to medical costs

- Monthly bank schemes: Around £13/month (excluding cancer-related costs)

- Key factor: Your specific situation determines the final price

If you have cancer or are in remission, you know that planning a holiday comes with an unexpected hurdle: finding affordable travel insurance. Many are shocked by quotes that exceed the cost of their trip. For example, one patient was quoted £3,500 for a two-week trip to France, while another found coverage for just £200 for a similar journey to Spain. This price variation isn’t random; it’s how insurers assess risk for pre-existing conditions.

Cancer patients can face premiums up to ten times higher than standard rates, even years after successful treatment. Some travelers receive quotes from £760 to £3,000 for the same destination. Insurers consider factors like cancer type, treatment status, time since diagnosis, and destination. Understanding these cost drivers can help you find better options.

I’m Ramy Saber, founder of GoTravelHunt. Through my research, I’ve learned that the key to affordable coverage is understanding what insurers look for. This guide will walk you through the costs and show you how to find policies that protect your health and wallet.

Average cost of travel insurance with cancer vocab explained:

Why is Travel Insurance for Cancer Patients So Expensive?

It can feel unfair to face high insurance premiums after a cancer journey. However, understanding why costs are high can help you find better options.

Insurers assess risk based on statistics, not personal stories. A cancer diagnosis, whether in treatment or remission, flags a higher probability of medical emergencies abroad. It’s not personal, even when a quote costs more than your flight and accommodation.

Pre-existing condition clauses are a key challenge. Standard policies often exclude pre-existing conditions, so for cancer patients, you must declare your condition and pay an additional premium for coverage. This is why specialized policies are so important.

The cost of medical care abroad is a major factor. Insurers calculate potential costs for emergency treatments, hospital stays, and medical repatriation. Compared to the USA, where medical bills can be astronomical, Europe is more reasonable from an insurance perspective.

Your destination makes a significant difference to the average cost of travel insurance with cancer. A trip to Europe will cost less to insure than one to the USA, purely due to the price of medical services.

Real-world quotes paint a stark picture. One person was quoted £3,500 for two weeks in France, while another faced quotes from £760 to £3,000 for a similar trip. A Glasgow couple initially received a £1,200 quote for Spain but found coverage for £200 by shopping around. Tom, a 29-year-old with stage three melanoma, was quoted £600-£700 for a week in Gran Canaria while on immunotherapy. These examples show the importance of comparing options.

This is frustrating, and research supports this. A new study in The Lancet Oncology found that even successfully treated cancer patients face discrimination when accessing financial services like travel insurance. This makes finding fair coverage essential.

The Average Cost of Travel Insurance with Cancer: What to Expect

There’s no single average cost of travel insurance with cancer. Unlike standard bookings, each quote is unique to your health journey. Costs can vary dramatically, from £200 for a trip to Spain to £3,500 for a French holiday. This variation isn’t random; it’s based on insurers weighing multiple factors. Understanding these factors can empower you when shopping for quotes.

For a broader perspective on comparing various holiday insurance options, our Ultimate Guide to Holiday Insurance offers helpful insights.

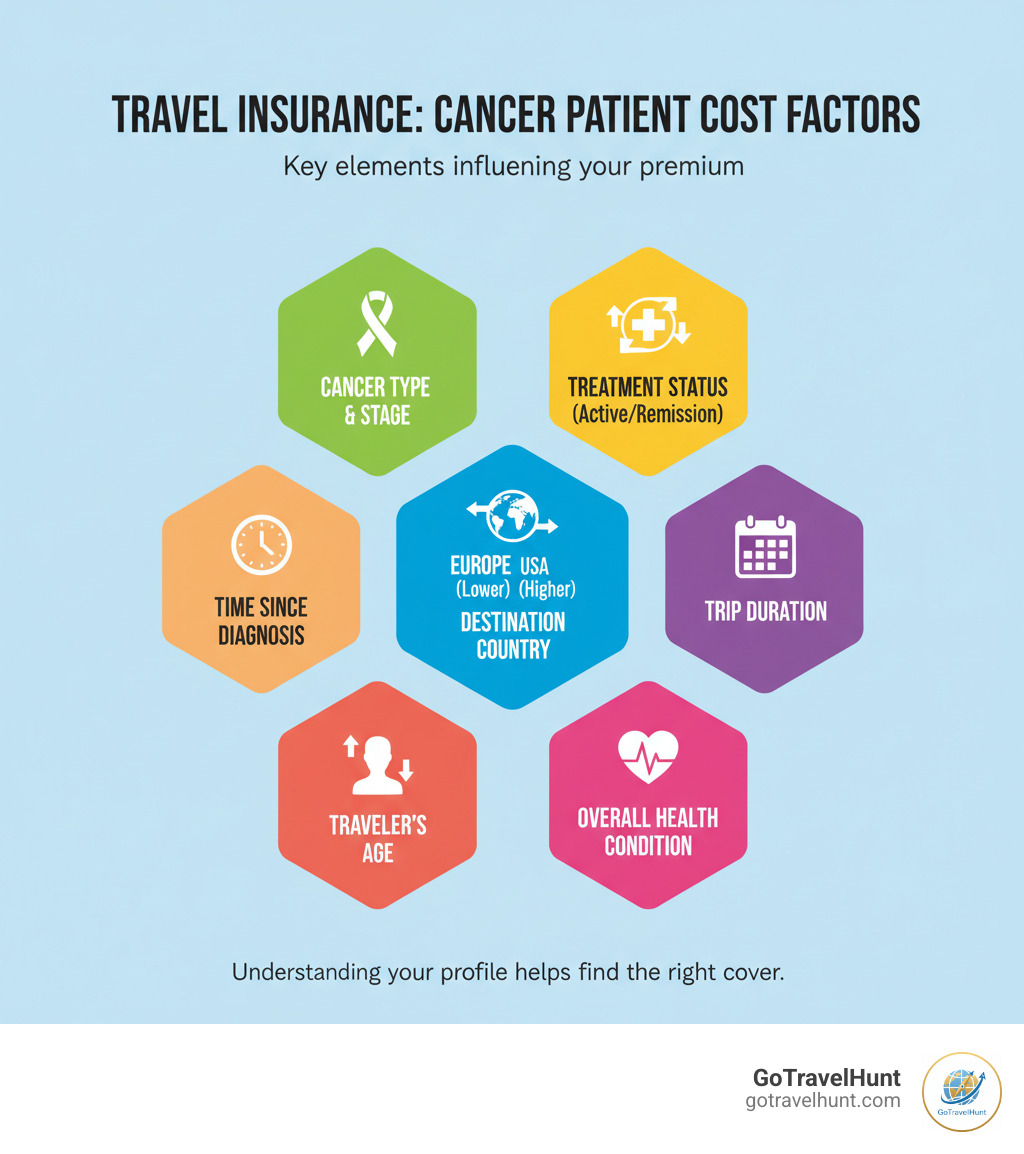

Key Factors That Influence the Average Cost of Travel Insurance with Cancer

Insurers use detailed medical screening to build your risk profile. Understanding these factors helps explain your quote.

- Cancer type and stage: More aggressive or advanced cancers (including breast, blood, bowel, lung, prostate, and others) mean higher premiums. Specialist insurers understand these nuances and cover a wide range of cancer types.

- Active treatment vs. remission: Active treatment (chemotherapy, radiotherapy, immunotherapy) is seen as higher risk. If you’re in remission, your options improve. Many insurers require a specific remission period for their best rates.

- Time since diagnosis: The longer you’ve been cancer-free, the better your terms. Insurers often look for a ‘stability period’ with no treatment or medication changes. France is even moving toward a ‘right to be forgotten’ after five years in remission.

- Destination country: Europe is more affordable to insure than the United States, where medical costs are astronomical. Countries with high medical expenses make coverage harder to get.

- Trip duration: Longer trips mean higher premiums. A weekend getaway will cost less to insure than a month-long trip.

- Age: Premiums increase as we get older. This is more pronounced with a cancer diagnosis.

- Overall health: Insurers also consider other pre-existing conditions, symptoms, side effects, and follow-up care.

How to Find Affordable Travel Insurance with Cancer and Comprehensive Coverage

The right policy isn’t just about price; it’s about effective protection. Here’s what matters.

- Medical emergency cover: You need substantial coverage (ideally millions of pounds) for transport, accommodation, and fees. Crucially, this must cover cancer-related events. Read the fine print, as some policies exclude this.

- Repatriation costs: This covers bringing you home if you become seriously ill, which can be extremely expensive. EHIC/GHIC cards do not cover repatriation, which is why travel insurance is vital.

- Trip cancellation and interruption: This coverage is vital as life with cancer can be unpredictable. It covers non-refundable costs if you must cancel or return home early for health reasons. Our Travel Cancellation Insurance guide has more details.

- Pre-existing condition clauses: You must be completely honest. Declare your cancer diagnosis and all other conditions thoroughly. Withholding information will invalidate your policy. Be prepared for detailed questions.

- Stability periods: Many policies require a ‘stability period’ (often 90-180 days) before your policy starts, meaning your condition has been stable. This affects eligibility and cost, especially for travelers over 60.

- Common exclusions: Pay attention to exclusions. Some policies exclude events related to your cancer or travel against medical advice. Your Certificate of Insurance has these details; read it thoroughly.

Understanding these elements makes the search manageable. For more on medical coverage, explore our guide on Trip Medical Insurance.

A Step-by-Step Guide to Finding the Right Policy

Finding the right travel insurance with cancer doesn’t have to be overwhelming. With the right preparation, you can find coverage that gives you peace of mind.

How to Prepare for Your Application

Before looking at policies, some groundwork will make the process easier.

First, talk to your healthcare team. Your doctor’s approval is essential, and most insurers require a ‘fit-to-travel’ letter. As the Canadian Cancer Society advises, travel decisions should be made in consultation with healthcare providers based on your health.

Next, gather your medical documents. Having details ready for the medical screening makes it smoother. You’ll need your cancer type and stage, diagnosis date, treatment details, and other health conditions.

Full disclosure is non-negotiable. While recounting your medical history is exhausting, failing to disclose your cancer diagnosis will invalidate your policy. This could leave you responsible for huge medical bills. The average cost of travel insurance with cancer is small compared to an uncovered emergency.

We recommend creating a medical document with your healthcare team’s contacts, a list of medications, and a summary of your diagnosis. Keep this in your hand luggage with your insurance documents.

Where to Look for Suitable Policies

Now, shop around. Patience is key, as prices vary dramatically.

Start with comparison tools like those on GoTravelHunt. Our platform simplifies comparing insurance for pre-existing conditions, helping you find policies for travelers with cancer.

Look beyond mainstream insurers. Specialist providers for pre-existing conditions often offer better quotes because they understand cancer. Their screening is more sophisticated, and they are more likely to cover rarer cancers.

Investigate bank account travel insurance, but with caution. These may exclude cancer-related costs, leaving you unprotected. Always read the fine print and ask about pre-existing conditions.

Persistence is key. Don’t give up after a few high quotes. Keep searching and comparing to find a policy that balances cost and protection. For more guidance, see our guide to Best Holiday Insurance.

Beyond Emergencies: Additional Benefits of Travel Insurance

While emergency medical and cancellation cover are key, a good travel insurance policy offers more. These additional benefits can transform your holiday from stressful to relaxing.

- Peace of mind: This is the most precious benefit. After your cancer journey, you deserve a worry-free holiday. Knowing you’re financially protected lets you relax and enjoy your trip.

- Lost baggage coverage: This compensates you for lost, stolen, or damaged belongings. It’s especially valuable if your luggage contains essential medications or medical equipment, providing funds to replace urgent items.

- Travel delay protection: This covers extra costs like hotels and meals if your flight is cancelled or delayed. For those managing energy levels or medication schedules, this can be a crucial benefit.

- Personal liability coverage: This protects you if you accidentally injure someone or damage property. It covers legal costs and compensation, preventing a potentially devastating expense.

- 24/7 assistance helpline: This is a lifeline when you need help fast in a foreign country. They can find English-speaking doctors, arrange transport, and help with translation. This round-the-clock support means you’re never alone.

When you’re comparing the average cost of travel insurance with cancer, these additional benefits are part of what you’re paying for. They create a complete safety net, making travel not just possible, but genuinely enjoyable again.

Frequently Asked Questions about Travel Insurance and Cancer

Here are answers to common questions about travel insurance and cancer.

Can I get travel insurance if I’m currently undergoing cancer treatment?

Yes, but it’s challenging. Finding coverage during active treatment (chemotherapy, radiotherapy, immunotherapy) is harder and more expensive than in remission. Insurers see ongoing treatment as a higher risk. Specialist providers often work with people in active treatment, but they conduct detailed medical screenings, so complete honesty is key. You’re unlikely to get cancer-related coverage without your doctor’s clearance for travel.

If the cancer is incurable, getting a policy is very difficult. When available, coverage will have limitations, such as exclusions or high excesses. Use GoTravelHunt’s comparison tools to find specialist insurers for these complex situations.

What happens if I’m diagnosed with cancer after I’ve already bought my travel insurance?

If you’re diagnosed with cancer after buying your policy and your doctor advises against travel, it can provide crucial support. Trip cancellation can reimburse non-refundable expenses, while trip interruption can cover costs of returning home early. Your policy should cover medical emergencies unrelated to your cancer; coverage for emergencies related to the new diagnosis depends on your policy terms.

Inform your insurer immediately after diagnosis and provide medical documentation. Always check your policy terms to understand your coverage.

Does a GHIC/EHIC card replace the need for travel insurance in Europe?

No, an EHIC or GHIC card is not a substitute for travel insurance. While it provides access to state healthcare in many European countries, it’s not comprehensive. It only covers state-provided healthcare, which may not be free, and doesn’t cover private treatment.

The most critical gap is repatriation. The EHIC/GHIC won’t cover the potentially huge costs of transporting you home if you’re seriously ill. It also offers no protection for non-medical issues like lost baggage, travel delays, or cancellation. For full protection, get comprehensive travel insurance in addition to your EHIC/GHIC card. Learn more in our European Travel Insurance guide.

Conclusion

The key takeaway is that traveling with cancer is absolutely possible. While the average cost of travel insurance with cancer can be high—ranging from £200 to over £3,500—and varies based on your situation, finding the right coverage gives you the freedom to live fully.

Understanding how insurers assess risk, though frustrating, puts you in control. Knowing what influences your premium helps you find better options for your dream trip.

Our most critical advice is to be completely honest with your insurer. Full disclosure is essential. Failing to declare your condition could invalidate your policy, leaving you responsible for catastrophic medical bills. This transparency is your best protection.

At GoTravelHunt, we’re passionate about making travel accessible to everyone. Our comparison tools and guides simplify the search. With patience and research, you can find a policy that offers peace of mind without breaking the bank.

Your diagnosis is part of your story, not the end of your travel adventures. With proper planning and coverage, your dream trip is within reach. Start exploring your options today.

If you’re planning travels beyond Europe, check out our guide to Travel Insurance Australia to help plan your next adventure with confidence.